We've already started to see what effect the tragedy in Paris will have on the markets. European stocks closed with moderate gains on Monday and those seeking security drove up defense stocks and the price of gold.

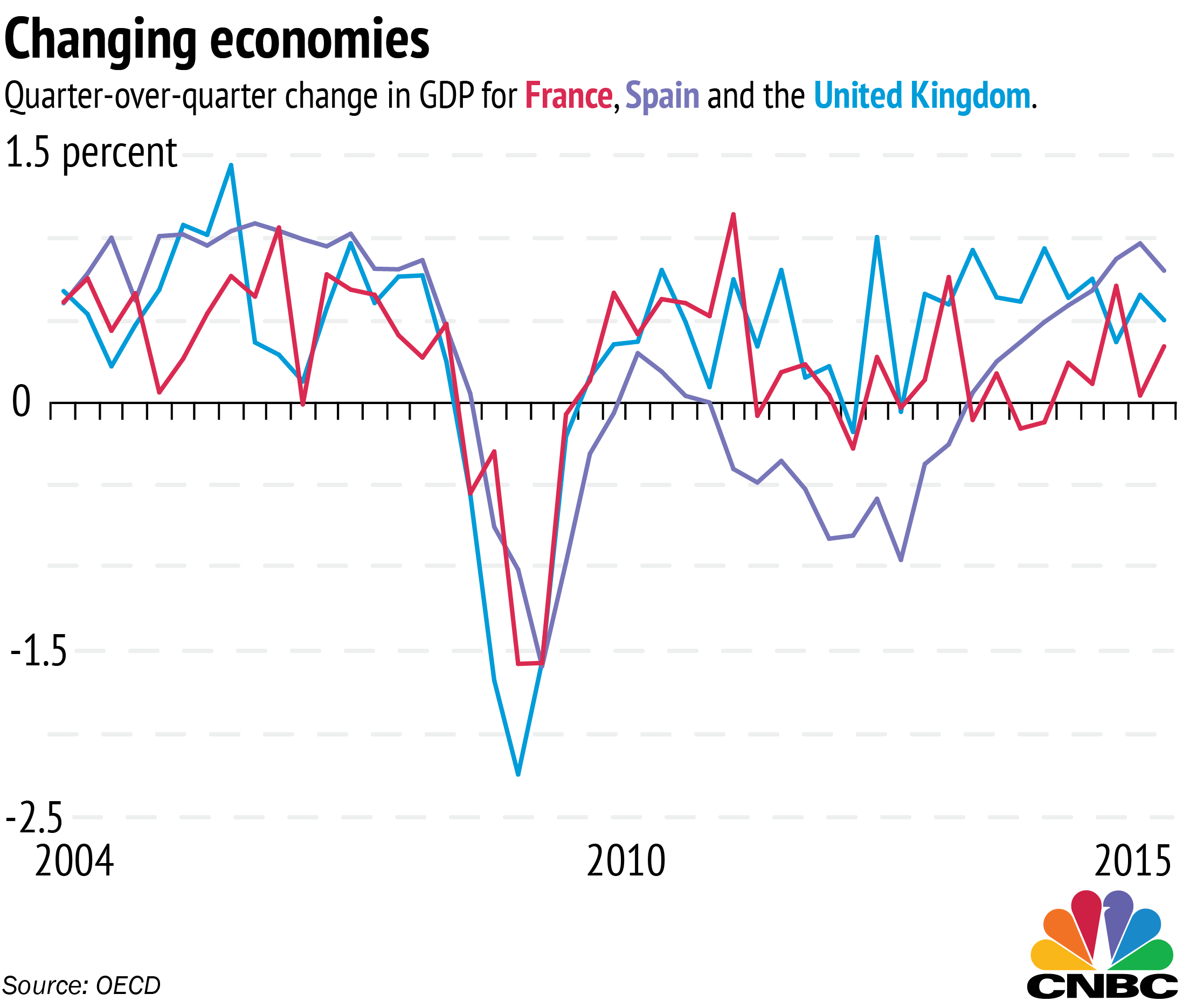

What about long-term effects? Experts worry that a decrease in consumer spending and international tourism could exacerbate an already weak global economy. The prospect of future attacks elsewhere could spread economic contagion to the EU as a whole.

While France is likely to see adverse economic impacts in the short term, the damage should be controlled in the long run, according to a note from Howard Archer, chief European and U.K. economist at IHS Global Insight.

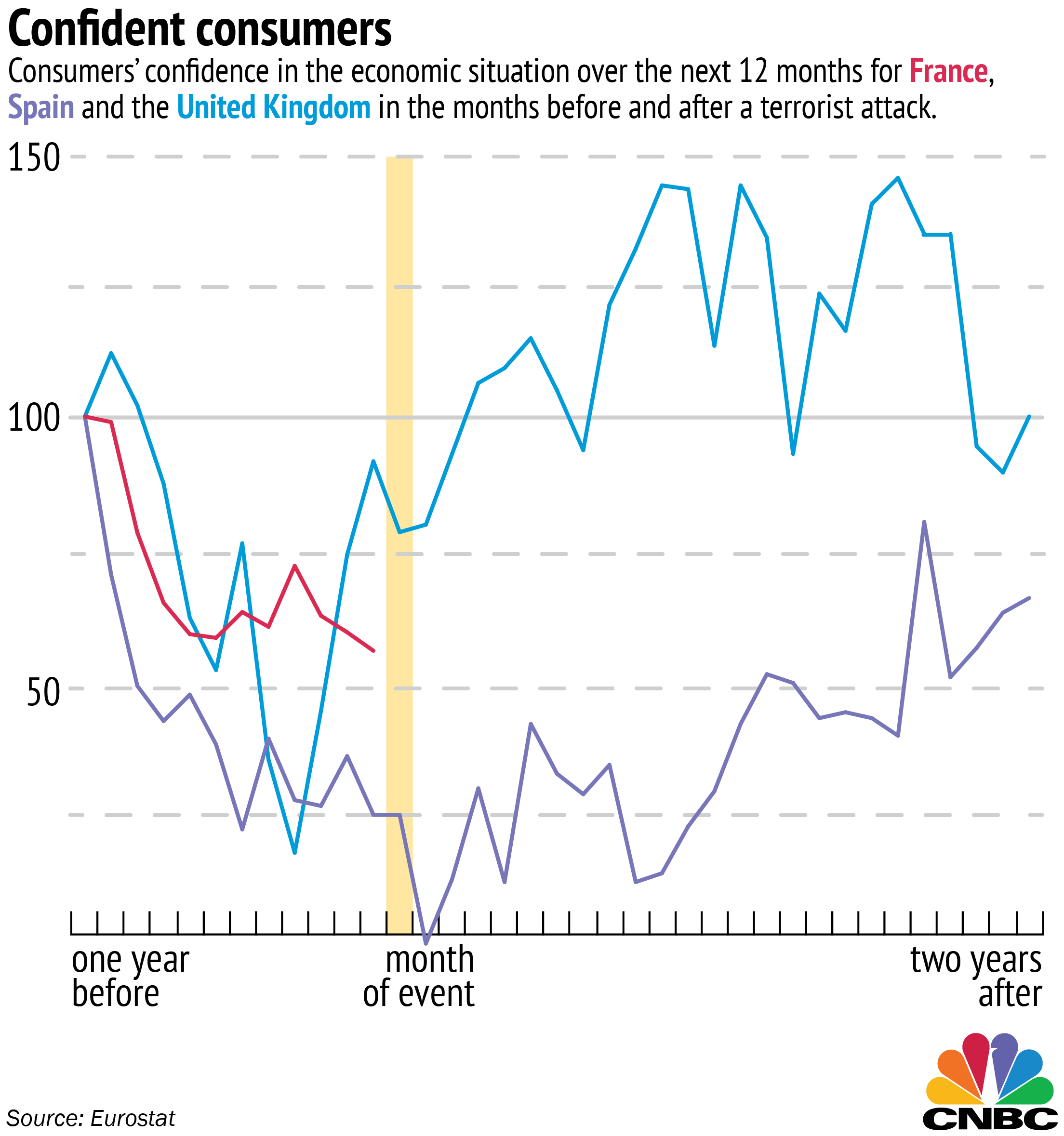

That's based on Archer's analysis of the experiences of Spain and the United Kingdom following terrorist attacks in 2004 and 2005, respectively. The London bombings in July of 2005 killed 52 people and wounded over 700, but had limited economic impact on the nation. In fact, consumer confidence ticked up in July and continued increasing until October of that year.