U.S. stocks closed mixed Friday, giving up most of their opening gains as oil reversed and inflation data increased expectations for a rate hike in the coming year. (Tweet This)

"I think today's been quite a watershed day in some ways because of the core PCE data this morning," said Lee Ferridge, head of macro strategy, North America, at State Street Global Markets.

Markets are thinking, "maybe we should start pricing the Fed back in," he said, noting the rise in the U.S. dollar against the euro following the report.

The three major averages still ended the week more than 1.5 percent higher for a second-straight week of gains. The Dow transports gained 1.6 percent for their sixth-straight week of gains, the first such win streak since the seven week of gains ended Nov. 28, 2014.

The core personal consumption expenditures price index, which excludes food and energy, is the Fed's preferred inflation measure and showed a 1.7 percent rise in the 12 months through January, the largest since July 2014.

"While most thought June was off the table (for a rate hike), this kind of data puts the path to getting to a June rate hike very clear, especially if the volatility in the market dissipates," said Jeremy Klein, chief market strategist at FBN Securities.

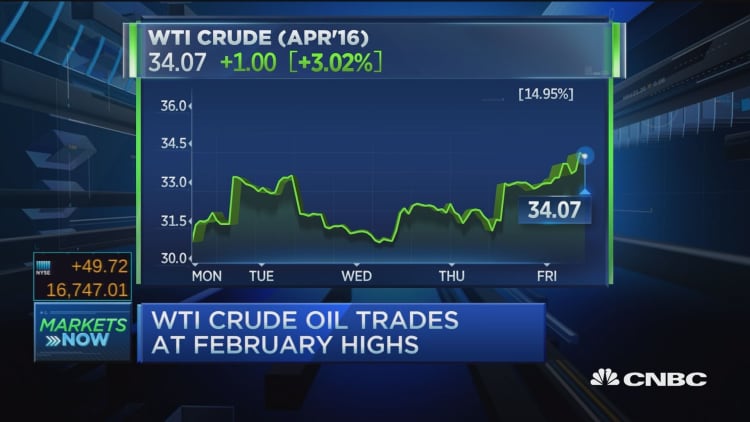

Oil futures for April delivery settled down 29 cents at $32.78 a barrel, after earlier rising and hitting resistance just below $35 a barrel.

The March contract rolled to April on Monday, and on a continuous basis WTI gained 10.59 percent for the week, its best since August. The April contract gained only 3.2 percent for the week.

The Russell 2000 rose about 2.7 percent for the week, for its second-straight week of gains, and ending within 20 percent of its 52-week intraday high, out of bear market territory.

Financials closed up 0.66 percent as the second-best S&P 500 performer Friday, while both the SPDR S&P Regional Bank ETF (KRE) and Bank ETF (KBE) outperformed with gains of about 2 percent. Utilities led sector declines with losses of 2.7 percent.

"That's helpful because a market that has utilities and Treasurys doing well, that's not indicative of confidence," said Quincy Krosby, market strategist at Prudential Financial. "Having money going into the financials ... I do think it's also indicative of the sense the economy is chugging along."

She also said increased expectations of a rate hike and higher oil prices helped financials rise.

Overall personal income and spending in January rose 0.5 percent, while core PCE rose 0.3 percent from the prior month.

"This is good news all around. Markets tend not to like rate hikes but when they're connected with economic growth that's a good (thing)," said Douglas Cote, chief market strategist at Voya Investment Management.

Read MoreRally on? Data, oil may hold the key

The U.S. dollar index held about 0.9 percent higher against major currencies, with the euro near $1.094 and the yen at 113.97 yen against the greenback. Pound sterling fell below $1.3900 to hit a fresh low against the dollar, going back to March 2009.

Gold futures for April delivery settled down $18.40 at $1,220.40 an ounce, down 0.8 percent for the week.

Treasury yields held a touch below session highs in late trade, with the at 0.78 percent and the 10-year yield at 1.75 percent.

"The one thing that concerns me, why I'm not a buyer here, is the fear trade is unwinding at the moment," said John Caruso, senior market strategist at RJO Futures.

"We've had a hell of a run up," he said of the week's gains in stocks. "Perhaps you've got some guys booking profits into the weekend."

Major averages 3-year performance

The Dow and S&P 500 both closed above their 50-day moving average, but the S&P failed to hold above the key 1,950 level. The index had topped that level Thursday as stocks rallied into the close.

"What we're seeing right now is the technical downtrends in the market are pretty well defined," said Lance Roberts, chief investment strategist at Clarity Financial. He said the trend lower in prices has increasingly shifted investor psychology from buying dips to selling rallies.

Read MoreShort sellers hitting energy at near-crisis levels

In other economic news, final consumer sentiment for February was 91.7, down from 92.0 in January.

Dow futures held about 100 points higher higher after the second revision on fourth-quarter gross domestic product showed a greater increase than expected, although the 1.0 percent annual rate was still slower than the 2.0 percent reported in the third quarter. Businesses were less aggressive in their efforts to reduce unwanted inventory, which could hurt output in the first three months of 2016.

Fourth-quarter GDP was initially reported at 0.7 percent, while expectations for the second revision was 0.4 percent, according to economists polled by Reuters.

"Markets are definitely reacting to good news domestically. There's still the possibility international developments can interrupt things," said Brian Nick, head of tactical asset allocation at UBS Wealth Management Americas.

European stocks closed more than 1 percent higher, while Asian equities also ended mostly higher.

Overnight, the G-20 meeting of central bank governors and finance ministers kicked off in Shanghai, and China's central bank governor Zhou Xiaochuan sent a message of confidence and repeated earlier reassurances the country would not stage another devaluation of its currency to support the economy.

"Those calming remarks were encouraging," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. He said Zhou's comments, some better-than-expected data and the rise in oil prices could help the recent rally in stocks turn into "something perhaps more durable."

The G-20 meeting is set to continue Saturday in Shanghai.

"The danger is now if there's nothing meaningful that comes out of the weekend and we have PCE, and jobs next week, that could be negative for risk next week," State Street's Ferridge said.

Major U.S. Indexes

At the end of Friday's session both the S&P 500 and Dow Jones industrial average remained within 10 percent of their 52-week intraday highs, out of correction territory. The Nasdaq composite remained more than 12 percent below its 52-week intraday high.

Read MoreEarly movers: RH, BABA, BIDU, JCP, WTW & more

The Dow Jones industrial average closed down 57.32 points, or 0.34 percent, at 16,639.97, with DuPont leading advancers and Coca-Cola the greatest decliner.

The Dow gained 1.51 percent for the week, with United Technologies the best performer and Chevron the greatest laggard.

The closed down 3.65 points, or 0.19 percent, at 1,948.05, with utilities leading six sectors lower and materials the top gainer.

The index rose 1.58 percent for the week, with materials the best performer and utilities the only decliner.

The Nasdaq composite closed up 8.27 points, or 0.18 percent, to 4,590.47.

The Nasdaq gained 1.91 percent for the week. Apple ended the week up 0.91 percent, while the iShares Nasdaq Biotechnology ETF (IBB) fell 0.13 percent for the week.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, was near 19.8.

About two stocks advanced for every decliner on the New York Stock Exchange, with an exchange volume of 1.0 billion and a composite volume of about 4.3 billion in the close.

High-frequency trading accounted for 49 percent of February's daily trading volume of about 8.86 billion shares, according to TABB Group. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

—Reuters contributed to this report.

On tap this week:

Saturday

Earnings: Berkshire Hathaway

*Planner subject to change.

More from CNBC.com: