After a substantial bounce for oil and energy stocks, it may be time to play for a drop, one trader contends.

"The fundamentals are actually showing that we have peaked in this commodity rally, and are due for a correction," Boris Schlossberg of BK Asset Management said Tuesday on CNBC's "Power Lunch."

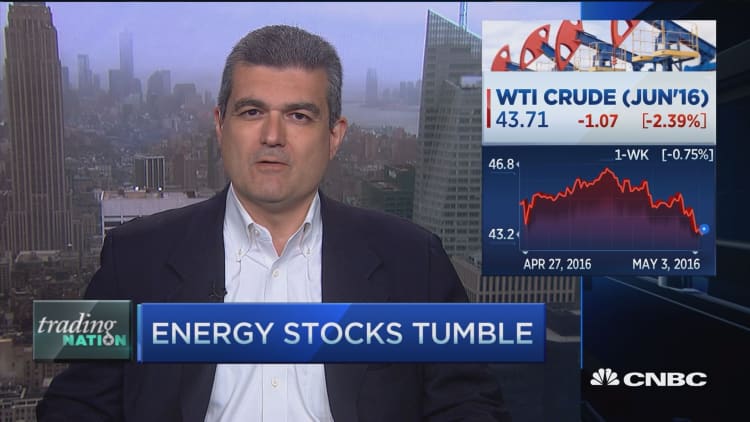

U.S. oil futures settled at $43.65 on Tuesday, dropping 2.5 percent, or $1.13 — continuing a three-day decline for the commodity. This has sent 95 percent of the companies in the SPDR energy ETF (XLE) into the red for the week.

While technical analyst Craig Johnson of Piper Jaffray said the XLE is set to go higher after pulling above its downtrend line, Schlossberg is adamant that the bounce from the $26 low is now over.

"Even though we may have a trend change, there's always scope for correction off this really strong balance that we have," he said, adding, "What's interesting here is that all the commodity movement has really been more of a short recovery moment rather than demand-driven."

Read MoreUS oil drops for 3rd straight day as glut worries return

The big concern for crude remains a bearish supply and demand imbalance. Despite oil's drop, OPEC countries actually increased their crude production to 32.64 million barrels per day in April, according to Reuters, their highest numbers in recent history.

This, coupled with an economic slowdown in oil-dependent countries like China, means crude supply outstrips demand for the resource, driving prices down.

Schlossberg believes that other countries are starting to feel the pinch.

"Last night, the Reserve Bank of Australia, the most commodity-sensitive central bank of all the major central banks actually lowered its interest rates," he said. "Now part of it could be that the Australian dollar has just gotten so strong, but another reason is that they may be anticipating the fact that the commodities sector is going to see a slowdown."

Piper Jaffray's Johnson, meanwhile, insists that "some good things are really starting to happen here in the energy sector and it looks like perhaps you can make more room for the energy stocks to work."

Despite its recent drop, the XLE is still up 9 percent on the year.