"One uncomfortable truth is that there are limits to what the Bank of England can do."

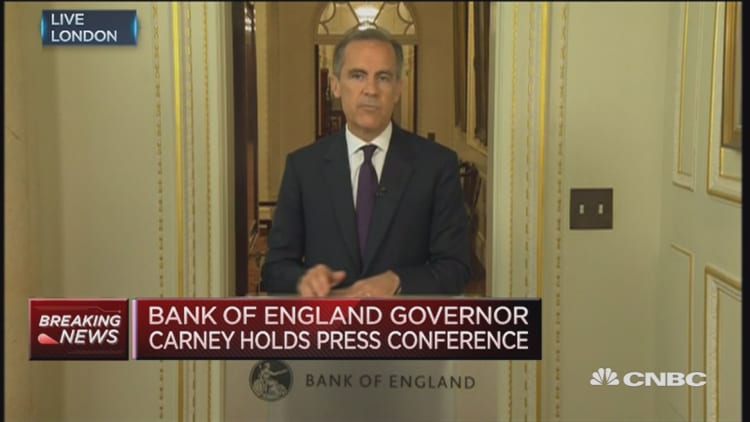

No, not the words of a disparaging economist, but a sentence uttered by the governor of the Bank of England himself.

Mark Carney used brutal honesty at his hastily arranged speech on Thursday afternoon. It may have left him open to accusations of being a pessimist by Brexit campaigners, but it summed up the mood of most market participants who find themselves in a world of negative rates and ultra-aggressive monetary policy.

"With interest rates approaching zero, the Bank of England is testing the limits of its powers," Laith Khalaf, a senior analyst at Hargreaves Lansdown, said in a note on Friday.

Benchmark rates in the U.K. have been held 0.5 percent for the last seven years and Carney hinted they could be pushed lower at its August meeting this year. Investors quickly rushed to re-price the news, sending two-year gilt yields below zero, sinking the pound and buoying the FTSE 100.

The central bank is unlikely to opt for a negative rate - like some of its neighbors have - through fear of hurting a financial sector that is still reeling from the crash of 2008 and has just seen a major plunge in its market valuation. Banks rely on some sort of yield and a negative rate effectively charges banks who park cash at the Bank of England.

Additionally, with the pound currently at a 30-year low, many expect inflation to shoot higher with foreign goods becoming more expensive in the country. And if consumer prices do lurch upwards, it becomes much harder for the Bank of England to cut rates further or launch a quantitative easing program, two stimulus policies that are seen as being able to stoke inflation even more.

"Easing likely will be modest, due to the much higher outlook for inflation following sterling's precipitous decline," Samuel Tombs, chief U.K. economist at Pantheon Macroeconomics, said in a research note Friday.

Instead, Carney's gloomy warning on the central bank's own limitations may have been directed at the U.K.'s finance minister, still currently George Osborne until further notice. Osborne has warned that more spending cuts could come after the Brexit vote, as opposed to a relaxation of public expenditure in order to fill the void left by the private sector.

More so-called austerity is likely to prove extremely unpopular but so is steering away from the plans that Osborne has overseen since 2010.

Meanwhile, Carney spoke Thursday about a range of policy tools that are available and analysts point to a resurrection of the Funding For Lending Scheme. This program - originally launched in July 2012 - aims to boost mortgage lending and stimulate house prices with some already warning of a dip in transaction volumes - at least in prime London locations.

Britons have long had a strong emotional attachment to their homes, using it as a retirement fund or boosting their own personal spending as their equity and financial confidence soars increasingly higher. Several analysts suggest that Carney will simply look to prop up the property market with hard times on the horizon.

"What I think Mr Carney was saying was 'look, I'm worried about the housing market. Or rather 'I want to get ahead of the curve on the housing market. I want to cut rates, I want to reduce potential mortgage payments, that's what we're going to do.'," Ewen Cameron Watt, a senior director at Blackrock Investment Institute, told CNBC Friday.

The knock-on effect, Cameron Watt explained, would be that beaten-down housebuilders - bruised badly by recent market moves - would find a floor if the central bank steps in the stimulate lending.

The Bank of England's monetary policy committee will announce its next rate decision on July 14.