Japanese game-maker Nintendo, which owns a stake in the developer of the wildly popular "Pokemon Go" mobile game, said on Wednesday that it had slumped to an operating loss in the quarter that ended June 30, 2016.

Nintendo's group operating loss in the April-June quarter stood at 5.13 billion yen ($47.33 million), compared to an operating profit of 1.15 billion yen in the same period a year earlier.

Net sales dropped 31.3 percent to about 62 billion yen, compared to 90.22 billion yen a year ago.

The Kyoto-based company said a combination of a decline in gaming hardware sales, fall in download sales as well as a stronger Japanese yen affected its earnings. Nintendo said yen strength resulted in exchange losses totaling 35 billion yen.

For the full fiscal 2017, Nintendo said it expects its operating profit to increase 36.9 percent to 45 billion yen.

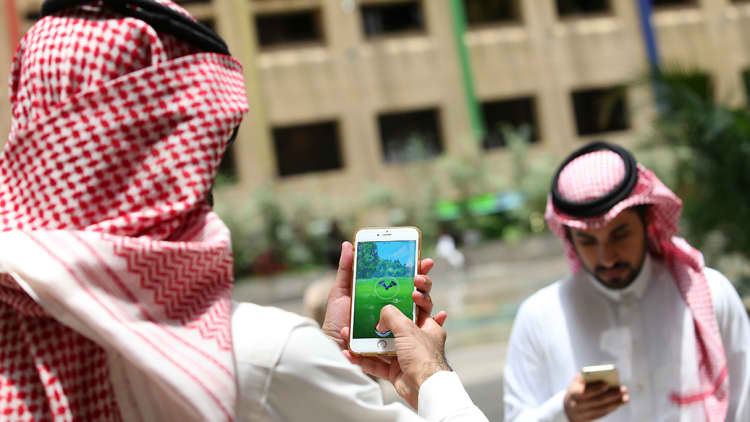

Investor focus on the storied gaming company has been heavy in recent weeks, as it reaped the rewards of "Pokemon Go."

Nintendo, which produces the Wii gaming console and has created famed video game characters such as Mario, has seen its shares rocket since the app's launch in the U.S., Australia and New Zealand on July 6, reaching a high of 32,700 yen on July 19 as investors and analysts hoped for a boost to Nintendo earnings.

Nintendo owns stakes in The Pokemon Company, which owns the Pokemon characters, as well as in Niantic, the U.S. gaming company that created the game.

Since the initial boost, however, the stock has been on a roller-coaster ride, amid rumors over trouble with the Japan launch of the game before finally launching in the country on July 22.

A number of investors have increased their short positions on the stock, in part due to an announcement from Nintendo on Friday in which it said "Pokemon Go" would have a limited impact on its income.

While the game itself is free, hopes had been high for monetization in the form of in-app purchases, as well as the potential for the game to have other commercial uses.

However, that potential revenue would be divided among game developer Niantic, rights holder The Pokemon Company, as well as Apple and Google, since the game is available on both iOS and Android platforms, before Nintendo made money off the game.

Analysts have given different estimates of what percentage of the revenue would go directly to Nintendo, which owns a 32 percent stake in The Pokemon Company, as well as an undisclosed stake in Niantic.

Lewis Ward, research director at the International Data Corporation, told CNBC his estimate was that 10 to 13 percent of direct revenues would go to the Japanese game console maker.

He cautioned, however, that Nintendo would not be a primary decision maker on how to monetize the game, instead relying on "the roadmap sketched out by the other two main development partners."

"But then again, the value to Niantic and The Pokemon Company is going to accrue, and Nintendo could unload those properties," Ward added.

Atul Goyal, an equity analyst at Jefferies, said in a note on Monday that because of all of the cross-shareholdings, Nintendo could receive "40 to 50 percent of the economics (or net profits) from in-app business of 'Pokemon Go'," either directly or indirectly.

Testing times for Nintendo's mobile strategy

"Pokemon Go" was the company's second foray into the mobile space, after it launching its first mobile app, Miitomo, in March, racking up a million users in three days.

Gaming sector veteran Nintendo had been hurt by the rise of smartphones because many gamers switched away from traditional consoles to cheaper, and often free, mobile alternatives.

Sales figures from video game hardware and software declined in the first quarter of fiscal 2017, according to Nintendo. Dedicated video game hardware sales fell 43.66 percent on-year to 25.1 billion yen in the three months ended June 30, 2016.

Dedicated video game software sales also fell 21.58 percent on-year to 34.85 billion yen for the same period.

"It took a long time for current Nintendo management to recognize that their target audience had shifted to mobile," Goyal said. "But even after that ..., [Nintendo's] speed of move, communication of strategy and execution so far has left a lot to be desired."

Nintendo's resistance on mobile came as a result of wanting to protect its legacy console business, but it yielded in 2015 with a partnership with mobile firm DeNA to push into smartphone apps and games.

Ward said the partnership with DeNA was a bright spot in Nintendo's future mobile aspirations.

"They partnered with DeNA out of Japan to co-publish about five games due out by March 2017," he said. "Miitomo is the first one, then we're going to see an Animal Crossing-based game, an Fire Emblem-based games. There's two more in the wings, maybe a big IP [intellectual property] like Mario," he said.

Goyal agreed, saying Nintendo's enormous intellectual property value was expected to be unlocked over the next three to five years.

"Pokemon Go is only the tip of the IP iceberg," said Goyal. Other popular franchises owned by Nintendo include The Legend of Zelda, Donkey Kong and Mario.

Nintendo also said it will launch an accessory for "Pokemon Go" called the "Pokemon Go Plus", which would alert users of the popular game whenever a Pokemon character was detected.

The Japanese game maker also hinted at more smartphone apps to come, which would aim to "maximize the population that has access to Nintendo IP."