How to interpret the rotation out of high-yielding stocks and into those with lower yields? First, it should be noted that the consensus opinion regarding Federal Reserve policy has clearly changed. For most of the first half, economists had assumed that lackluster economic data, most notably the weak employment reports in April and May, would keep the Fed from raising interest rates until 2017 at the earliest. The sentiments were further reinforced by the belief that the Fed would be reluctant to act prior to the November 8 elections.

Now, having received very positive employment reports for both June and July, the odds of at least one rate hike by the end of the year have increased. In fact, the odds of a hike by the Fed's December meeting are now up to nearly 60 percent.

Reflecting those expectations, the yield on the 10-year Treasury bond has increased from 1.47 percent on June 30 to 1.57 percent now, and the yield on the 2-year Treasury bond has increased from 0.58 percent to 0.81 percent over the same period.

So, if interest rates are now higher, and are also expected to increase at a more rapid pace than previously expected, then the value of owning stocks (and bonds, for that matter) for their yield diminishes.

The second reason for the rotation out of dividend stocks is that high-yielding sectors generally have inferior growth profiles compared to those with lower dividend yields. If we are indeed heading into a period of accelerating economic growth, as the latest employment reports seem to suggest, then you would want to have greater exposure to more cyclical, economically-sensitive companies that will benefit most from the growth acceleration.

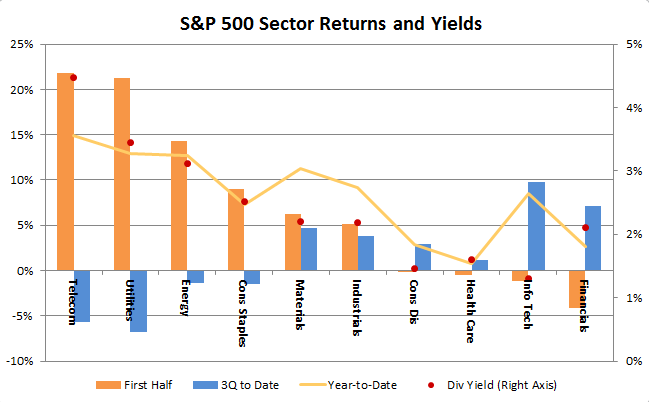

Thus far in the third quarter, four of the best-performing sectors have been information technology, materials, industrials, and consumer discretionary - all sectors with relatively low dividend yields but better prospects for earnings growth as the economy improves.

Finally, I would be remiss not to mention the special case of the financials sector...again. We have been warming to the banks, which make up the largest component of the S&P 500 Financials, for a few reasons. First, the sector has been, until recently, a rather dramatic under performer, with the KBW Bank Index trailing the S&P 500 by more than 14 percent from the end of 2015 through July 30 (that under performance has since been cut nearly a half).

If we combine the sector's relative under performance with historically low valuations on a price-to-book value basis, it seems that the risk/reward trade-off is relatively positive.

Secondly, banks stand to benefit from rising interest rates as interest earned on their assets will increase more rapidly than interest paid on their dividends - a posture referred to in the banking industry as being "asset sensitive." And finally, because bank earnings will rise with interest rate increases, bank stocks can offer some portfolio insurance against Fed interest-rate increases.

This is important as we have all seen how the market can react to the prospect of Fed rate hikes, from the 2013 "taper tantrum" to the correction very early this year when it appeared that the Fed was ready to hike rates in earnest.

So, the rotation we've seen thus far in the third quarter makes perfect sense given recent economic data. The real question is whether or not we are actually on a path to sustainably higher economic growth. We've experienced numerous false starts over the past several years.

In each case, the green shoots of economic acceleration, which led to the selling of rate-sensitive assets, turned out to be just a mirage. We find it best not to become too enamored with either narrative. Instead, we remain fully invested but defensive, with the ability to participate in an eventual improvement in the economy while also being able to withstand more of the same (or worse).