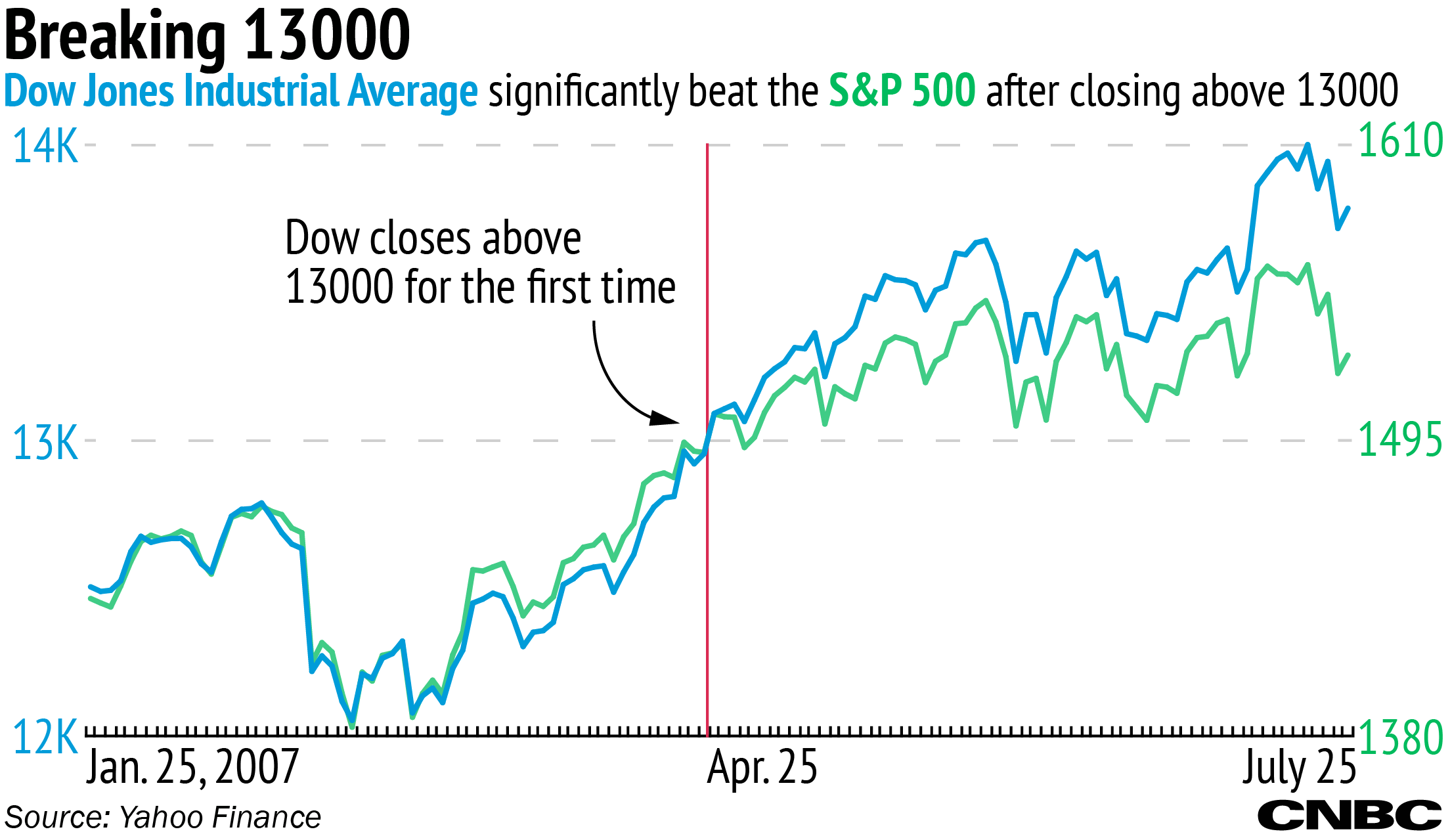

The Dow Jones Industrial Average is hitting all-time highs and closing in on 19,000 for the first time. If history is any guide, that psychological triple-zero barrier suggests more gains are to come.

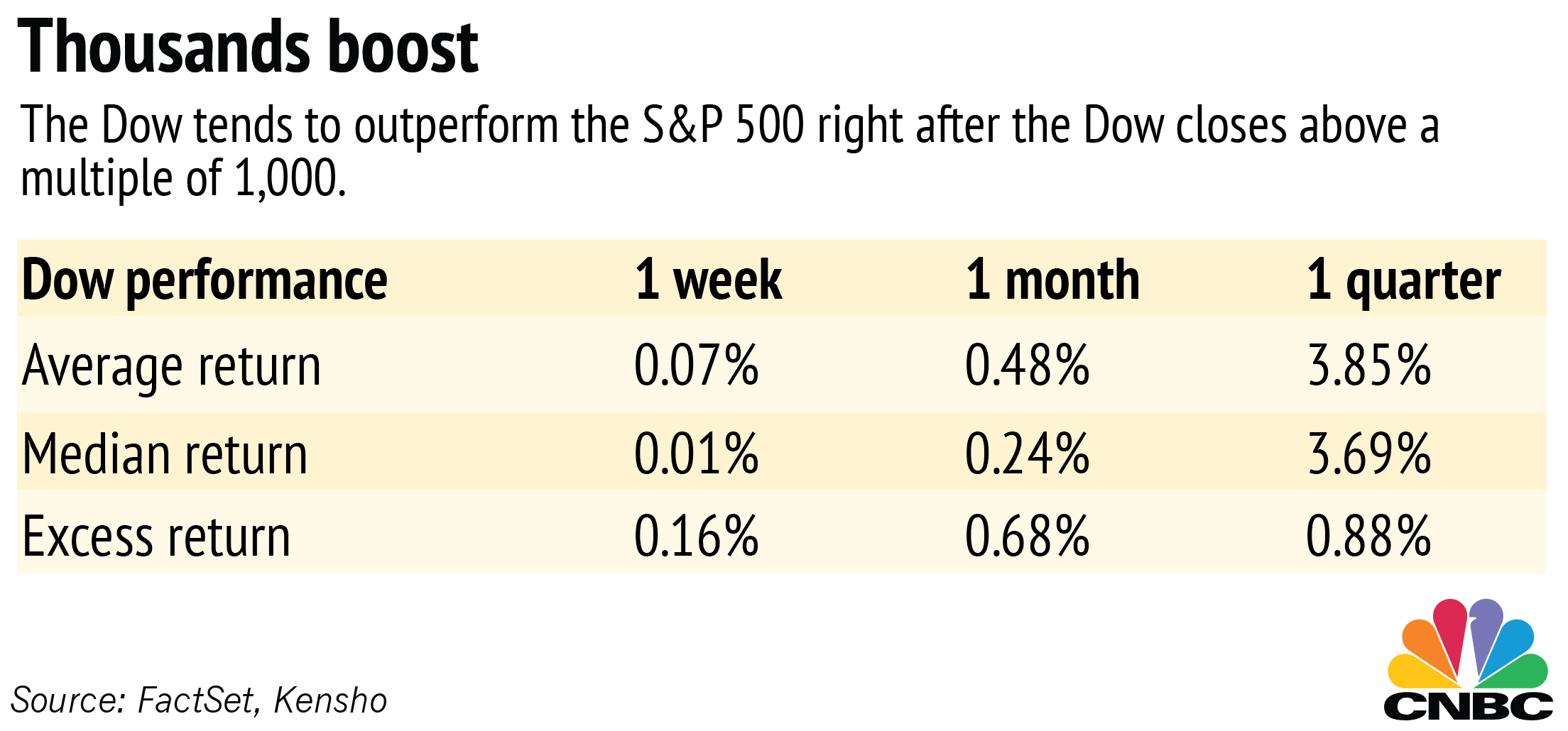

Based on market data from the past 30 years, when the Dow has crossed levels like 2,000, 3,000, 4,000 ... all the way to 18,000, we can expect traders to push it up even higher, according to data from Kensho. The Dow doesn't just go up, but it outperforms the S&P 500 along the way.

The trend is true not just for a quick one-week return, but also one-month and one-quarter returns. Here's a full summary of the data, going back to January 1987, when the Dow closed above 2,000 for the first time. That's 17 different instances, all the way through the first close above 18,000 in December 2014.