The "experts" weren't the only ones surprised by Donald Trump's victory.

It seems that short sellers — people who bet that individual stocks were going to fall — also were caught unaware by the electoral upset on Nov. 8.

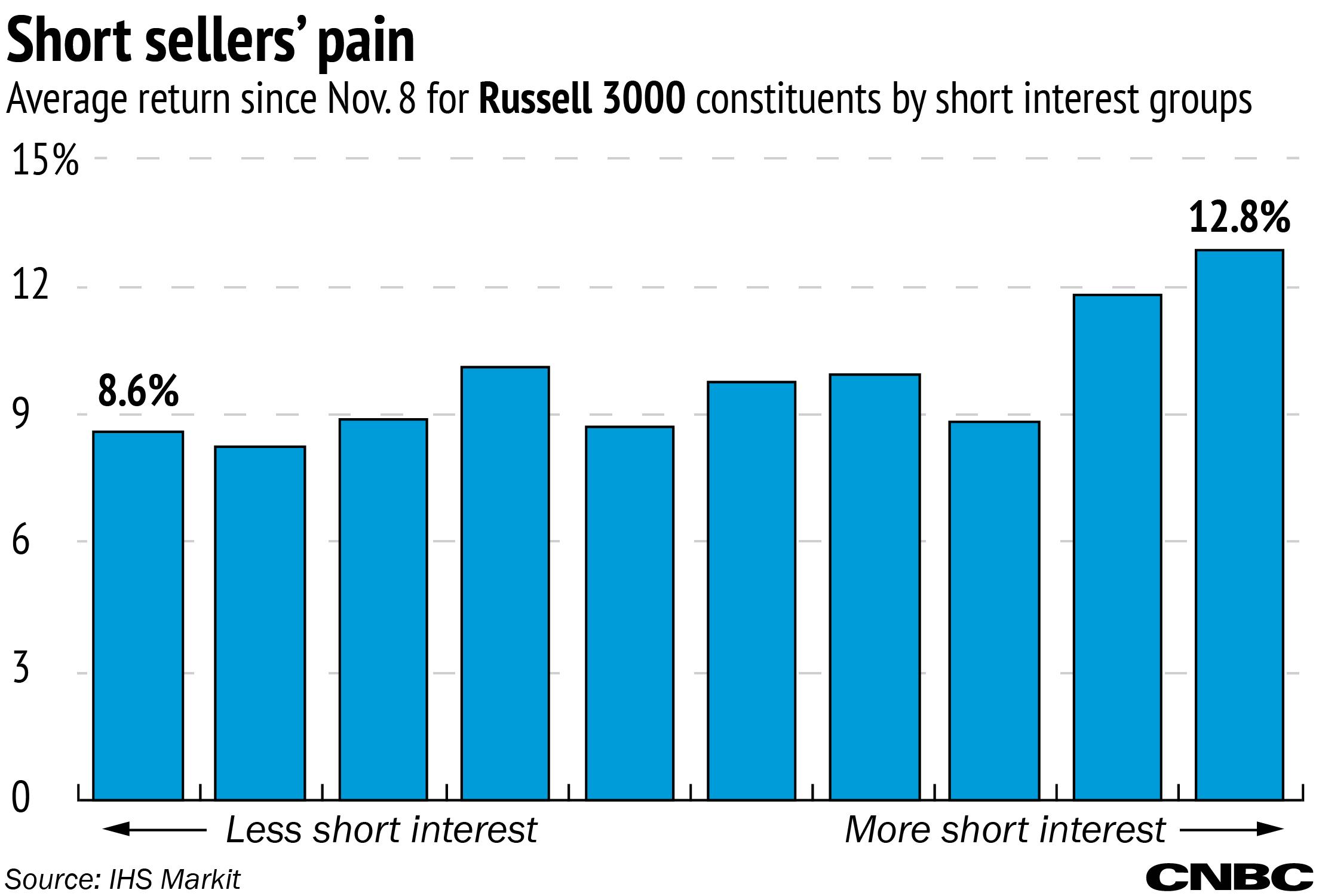

The companies with the highest levels of short interest prior to the election have rallied the most in the days since, according to data from research firm Markit. The majority of stocks on the Russell 3000 have seen gains in the past two weeks, and those gains have been concentrated in the stocks that short sellers were betting would drop following the election.