A prominent bond broker says his clients who are holding Puerto Rican debt are just about "suicidal" after President Trump threatened to wipe them out.

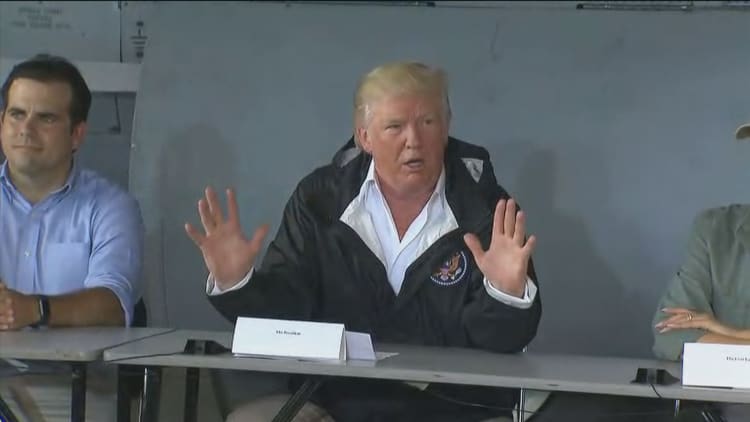

After visiting the devastated island, Trump said the U.S. territory's $72 billion debt should be wiped away. Most of Puerto Rico's credits are now moving through the Title 3 bankruptcy process.

While Trump can't erase the island's debt obligations, the dealer, who wished to remain anonymous, told CNBC that bondholders worry the U.S. will start giving new loans to Puerto Rico, as requested by its governor.

"The thing to watch is how will FEMA fund Puerto Rico. Will it be grants or new loans? If it's new loans, that could mean current bondholders won't get paid," said the dealer. "The priority will be to pay back the new loans that are needed for immediate reconstruction."

Trump did say bondholders would have to take a hit.

"They owe a lot of money to your friends on Wall Street and we're going to have to wipe that out. You're going to say goodbye to that, I don't know if it's Goldman Sachs, but whoever it is you can wave goodbye to that," Trump said Tuesday in an interview with Fox News.

Bondholders were already expected to take a "haircut," or reduced repayments, and bond strategists said it's likely they could get an even bigger hit if the U.S. provides new loans. Puerto Rico's population totals just 3.4 million and its debt burden has long been unwieldy. The commonwealth's debt to GDP is 68 percent, compared with an average 17 percent for a U.S. state.

Strategists warn Trump's comments should not necessarily be taken literally. Budget Director Mick Mulvaney said Wednesday not to take the president's comment "word for word."

Puerto Rico's bonds sold off sharply Wednesday, with the benchmark general obligation bonds trading at just 36 cents on the dollar, down about 7 cents from Tuesday.

WATCH: Hedge fund manager owns nearly $1B of Puerto Rico bonds