Chances are you've heard of a 401(k) plan. It's one of the simplest, most effective ways to build wealth and prepare for retirement.

If your employer offers one, you're may well be enrolled in it. But there's a big difference between enrolling in your 401(k) plan and actually understanding how to use it most effectively.

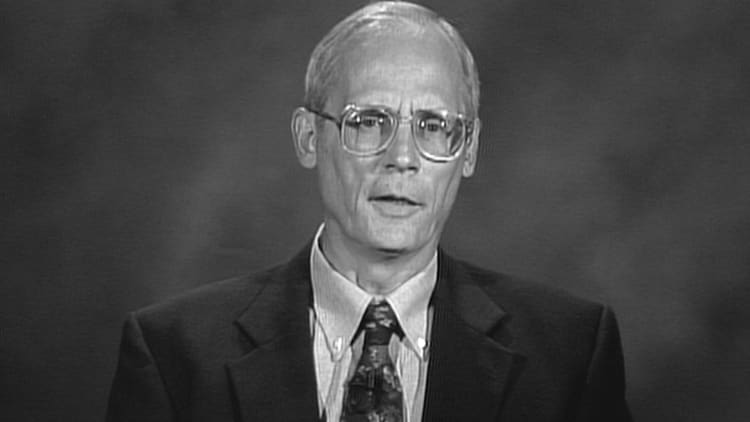

Sure, signing up is a good start, but it's "not enough," says personal finance expert Suze Orman. "No gold stars for that," she writes on Money.

It's important to actually understand how the retirement plan works: how the money is invested, if your employer offers a Roth option and if you're getting the highest match you can.

What Orman has found is that "millennials are often clueless about what they are getting so very wrong about their 401(k)s."

She continues: "At best, the collective level of understanding is fuzzy, which makes some sense given that you didn't have to do much to get started. Many employers automatically sign up new employees for their plans. There is much to love about automatic enrollment, but it's a costly mistake to assume all the preset features that come with auto-enrollment are the best options."

To get the most out of your 401(k) plan in the long run, Orman offers three basic steps:

1. Sign up for the Roth option

When enrolling, you may have two choices: A traditional 401(k) and a Roth 401(k), which more and more employers are now offering. With a traditional 401(k), you contribute pre-tax money and get an upfront tax break. When you withdraw your funds in retirement, every penny will be taxed as ordinary income.

With a Roth 401(k), the process is reversed: There's no upfront tax break, but you can withdraw your contributions and earnings tax-free in retirement.

"Roths really make sense when you're young and in a lower tax bracket, which means paying taxes upfront won't hurt as much," says Orman, yet "less than 10 percent of young adults are saving in one."

2. Take full advantage of the 401(k) match program

If your company offers a 401(k) plan, it may also offer a 401(k) match, which is essentially free money.

The way it works is, your employer will match whatever contribution you put towards your 401(k) up to a certain amount. For example, if you choose to put 4 percent of your salary directly into your account, your employer will put in that same amount as well, in effect doubling your contribution.

But you only get their money if you put yours in first. And, according to a 2017 survey from 401(k) provider Betterment for Business, nearly a quarter of Americans aren't taking full advantage of this opportunity to pad their savings.

Find out exactly how much you need to put in to get the full company match and start contributing at least that amount.

Even if you have student loans or are paying off credit card debt, "you are to never pass up the full company match," says Orman.

3. Keep your hands off your 401(k) until retirement

Once you set up a 401(k) account — or any other retirement savings account for that matter — keep your hands off of it.

Besides facing a 10 percent early withdrawal fee, you're putting your financial future at risk by preventing your retirement savings from growing over time if you break open that particular piggy bank.

"Empty the account, and you've got nothing to compound," writes Orman. "Talk about an expensive opportunity cost."

Like this story? Like CNBC Make It on Facebook!

Don't miss: Suze Orman says this is the 'new retirement age'—and it might make you cringe