A new rule proposed in the Senate tax bill could upend the way automated investment platforms move your money.

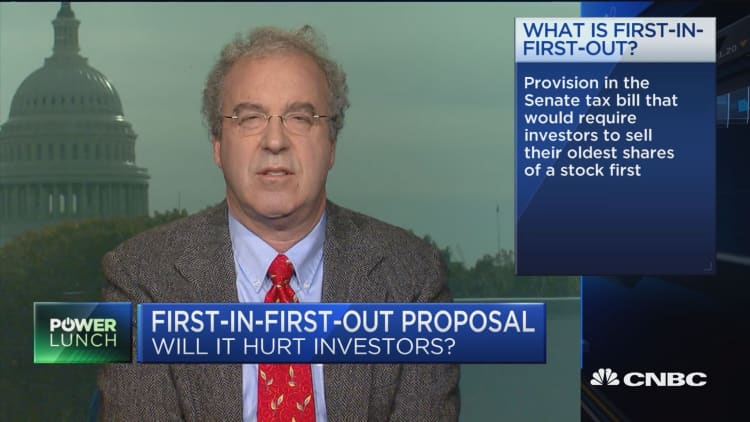

The first-in-first-out proposal would change how you can sell stocks from a taxable brokerage account. Currently, investors are able to pick which tax lot they want to sell when they have acquired multiple positions over time.

But a first-in-first-out only method (FIFO) would require investors to sell the shares they bought first — which are often the ones that have acquired the biggest gains.

"It basically means higher taxes for investors because they have less control," said Alex Benke, vice president of advice and investing at Betterment, a provider of automated investing services.

The change would prompt Betterment to switch from the algorithm it currently uses to help investors identify the best lot to sell when selling a specific stock. The algorithm picks lots by first prioritizing losses before any gains. Within each category, the algorithm targets lots with the highest cost basis, which typically have smaller gains.

The company's algorithms are already set up to use first-in-first-out as a default method.

"If the rule is changed, we would just flip a switch," Benke said.

Betterment's selection strategy will still work with first-in-first-out, but would be "much less efficient," according to Benke.

A new charitable giving feature that Betterment recently launched would also be affected. That feature allows Betterment users to donate shares directly from their accounts to selected charities.

While the system currently targets users' most appreciated shares for charitable giving, the first-in-first-out method would have to be used instead, Benke said.

The change would also affect savers who are focused on shorter-term goals, such as those who are saving for a down payment for a house. Betterment typically uses a selection strategy to choose lots for those investments as well.

"We would have to do first-in-first-out for that, which would result in a larger tax bill typically," Benke said.

One bright spot in the first-in-first-out proposal is the Senate Finance Committee's recent elimination of mutual funds from the rule, Benke said. Fund companies will be able to use other lot selection strategies that could reduce taxes for investors. But there's still the risk that a fund company's selection might not be best for an individual investor's particular situation, he said.

The implementation of FIFO would impact investors in different ways, according to Craig Birk, executive vice president of portfolio management at Personal Capital, a financial software and wealth management company.

"It will change the manner in which we do tax loss harvesting, but we do think tax loss harvesting will still be very beneficial for clients," Birk said.

Investors most affected will include those who have accumulated the same position in large amounts over time, such as those who own a company stock or a limited number of index funds they have invested in over time, he said.

Those with more granular portfolios would have the ability to take gains in some areas and losses in others to keep the portfolio balanced, Birk said.

For now, investors may want to wait and see before making any rash moves ahead of the prospective legislation, according to Birk. If the bill passes, investors might consider selling some of their higher costs basis lots while they still can, he said.

"We don't want people to panic and do something they may regret if the bill changes or fails," Birk said. "We're advising clients to prepare now, but wait until we get closer to the end of the year to do anything differently than they would otherwise."

More from Personal Finance:

Entrepreneurs: Grab these last-minute tax breaks while you still can