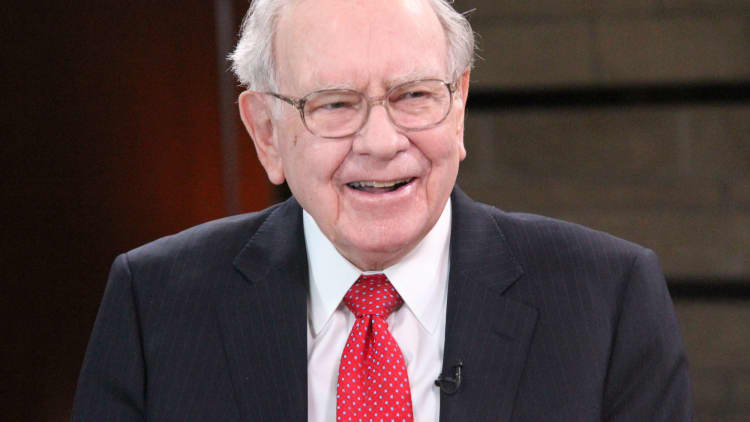

Legendary investor Warren Buffett is a proponent of long-term investing: When he puts money into new companies, he looks for businesses that will still be competitive 10 or 20 years down the line.

You can set yourself up for a successful future by thinking long-term, too. Your investments become exponentially more valuable when you give them years or decades to grow.

Here are four steps for making the most of long-term investments.

1. Diversify

First and foremost: Create a diversified portfolio. You want "something that is letting you be in a lot of different places all at the same time," Andy Smith, a certified financial planner at Financial Engines, tells CNBC Make It.

That means making sure you have a mix of investments across various categories. For example, if you choose to invest in index funds, don't just go with the S&P 500. "You can't just pick one index and think that all of your work is satisfied," says Nick Holeman, a certified financial planner at Betterment. "There's smaller companies in the United States, there's companies in Europe and Asia and Australia and there's bond indexes."

To make sure you're properly diversified, look into resources like target-date funds and robo-advisors, which automatically create a diversified portfolio of both stocks and bonds for you. You can also use a traditional advisor, although most first-time investors usually don't have enough wealth yet for the fees to be worth it.

2. Pick the best account

For most people, the biggest long-term goal is saving for retirement. To get started, make sure that you're taking advantage of any company match if you have access to an employer-sponsored 401(k) plan. Not doing so is basically losing out on free money.

Otherwise, there's no set formula for which type of retirement account is going to be right for you, so read up on the differences between them and talk to a trusted financial advisor about what works with your current lifestyle and future goals.

Holeman says that choosing the right type of account is "equally as important as setting up the proper investment."

But don't overthink it, Smith warns. "The problem that we see a lot of times is that people get too smart for their own good," he says. "They try to make it too complicated than what it really needs to be. You've got a 401(k), save in your 401(k)."

3. Choose the right level of risk

If you're young with decades ahead of you to save, you can likely afford to take on a higher level of risk than someone in their 50s or 60s. Make sure that you're taking on enough — but not too much — and stick with it.

"Investing is not for the faint of heart," Holeman says. "The stock market goes up and down very frequently and if you follow the news, you would think that every day is the impending doom for the stock market and that can be scary."

Instead of dwelling on the daily upsets of the market, think about the variables that are within reach. "You cannot control the stock market, that is out of your power," Holeman adds. "But you can control your fees, your taxes, your risk, and your behavior."

4. Make regular contributions

Remember that investing can't do everything for you.

"Investing in the stock market, historically, has been the best way to build wealth for every investor out there," Holeman says. "But the thing that people don't remember all the time is that just because you pick the right investments, if you don't save enough into those investments, it's not going to matter."

If you want to make your money work for you, save as much as you can as early as you can. "You could have Warren Buffett managing your portfolio for you but, if you only save $10 a year, you're not going to retire a millionaire," Holeman adds.

Make things easy for yourself by automating your investments and having a certain amount of money transferred over each month. If you never see the money, you won't be tempted to spend it instead.

Don't miss: Warren Buffett's winning investing strategy can be applied to any purchase you make

Like this story? Like CNBC Make It on Facebook!