As CNBC's Jim Cramer sees it, the stock market is in the middle of a full-fledged stand-off between the bulls and the bears.

The bulls got a win with Friday morning's jobs report from the U.S. Labor Department that said the country added 213,000 non-farm jobs in June. Stocks rose after the report was issued.

But the bears were already reeling from the official start of the U.S.-China trade war that came just after midnight on Friday, in which the two nations exchanged $34 billion worth of tariffs.

And while Cramer was astonished by how many jobs were being created without a serious uptick in inflation, he couldn't get too bullish considering the damage that tariffs could still do to the U.S. economy.

"I’ve said many times that trade is a tough issue and we may need to accept some short-term pain if we’re going to ever get our trading partners to play fair. But for the moment, that short-term pain does hurt," the "Mad Money" host said Friday.

"So is our economy strong enough to keep on trucking even in the face of these negatives? I think we’ll get some real insight into that as companies start reporting next week," he said.

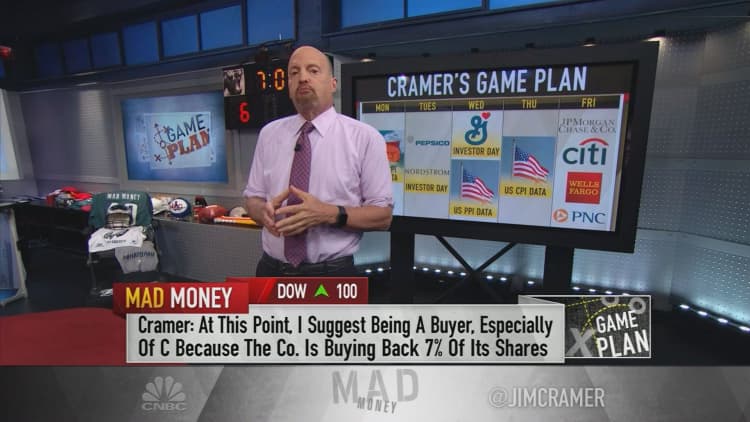

With those opposing forces in mind, Cramer turned to his weekly game plan:

Monday: Chinese economic data

Chinese government officials will release their latest consumer and producer price indices on Monday, giving the rest of the world a glimpse into how China's economy is faring amid the escalating trade dispute.

"I suspect the Chinese aren’t nearly as confident as they sound because, as I keep stressing, China needs our economy more than we need theirs," Cramer said.

And given China's level of debt, the "Mad Money" host wasn't sold on the idea that China would never give in to the White House's pressure.

"The punditocracy has convinced itself that the Chinese Communist Party will never give in because they take a 1,000-year perspective," he said. "Believe me, their debt situation is so precarious that I don’t even think they can hold out for 1,000 days."

Tuesday: PepsiCo, Nordstrom analyst meeting

PepsiCo: If you own shares in PepsiCo, Cramer warned that there could be more pain than gain after the company's Tuesday earnings report.

"I expect the stock to trade lower, but this company has a lot of levers" that could help the soda and snack maker bring out value, he said.

He added that his charitable trust, which owns shares of PepsiCo, would hold onto the stock despite concerns that a weaker-than-expected quarter could decimate the stock "because there are so many strengths that are being masked by carbonated beverage declines and market share losses to arch-rival Coca-Cola."

Nordstrom: An analyst meeting at Nordstrom could push shares of the retailer higher if management explains last quarter's weakness, Cramer said.

"It’s hard to imagine them really screwing this meeting up as badly as they did the conference call" last quarter, the "Mad Money" host added.

Wednesday: General Mills analyst meeting, U.S. economic data

General Mills: General Mills' analyst meeting will serve as another "test of recent strength" for the recovering consumer foods group, even as the company has been in recovery mode itself after some time in the doghouse, Cramer said.

"Generous Mills, as we used to call it, hasn’t been all that generous of late as business has slowed and many think they paid too much for Blue Buffalo," he said. "Let’s hear more about debt pay-down and perhaps a further restructuring to bring out value."

U.S. economic data: The federal government will release the U.S. producer price index on Wednesday, and Cramer was hoping to see a continuation of the job report's patter: growth with little inflation.

"Remember, the bulls need a sign that the Fed will slow down its rate hikes if the trade war does too much damage to the economy," he said.

Thursday: U.S. economic data

The U.S. consumer price index will be released Thursday. Cramer said this report, along with the producer price index, could determine the Fed's next move.

"A hot PPI and a hot CPI? Well, let’s just say the Fed will be forced to keep tightening," he warned.

Friday: J.P. Morgan, Citigroup, Wells Fargo, PNC Financial

Friday will deliver a whirlwind of earnings as J.P. Morgan, Citigroup, Wells Fargo and PNC Financial issue their quarterly reports.

But "the bank stocks [have] been horrendous," Cramer said. "We’ve had almost three weeks of relentess downside pressure in this sector."

What could dull the pain? Anything that would augment the banks' lending revenues, which could be threatened if long-term interest rates stay flat, the "Mad Money" host said.

"At this point, I’d rather be a buyer than a seller, especially with Citigroup because, as we've been telling ActionAlertsPlus.com club members, the company’s buying back 7 percent of its shares this year and will be doing the same next year," Cramer said. "I simply don’t see how its stock can continue to go down with that kind of trampoline underneath."

Final thoughts

Cramer's final advice for the week ahead? Watch the bull-bear tug-of-war closely — and play it carefully.

"Today, positive employment figures trumped negative tariffs," he said. "Can it continue? I think earnings could break the tie unless, of course, China blinks — highly unlikely, but we’ll never have a better time to take on the PRC than we do right now with this insanely strong job growth with almost no inflation."

WATCH: Cramer's game plan and the bull-bear battle

Disclosure: Cramer's charitable trust owns shares of PepsiCo, Nordstrom, J.P. Morgan and Citigroup.