Rupert Murdoch clearly would rather sell Twenty-First Century Fox's movie and TV assets to Disney, but he won't be able to dismiss any sweetened Comcast bid out of hand, New Yorker staff writer Ken Auletta told CNBC on Tuesday.

"You can't have large shareholders and say to them, 'Screw you. I'm doing the deal no matter what.' [Murdoch] is not an autocrat in this sense. He's not in total control," said Auletta, who has decades of experience following the media industry. He's also a best-selling author who recently explored how legacy companies are dealing with inroads from well-healed tech titans.

On June 20, Disney sweetened its all-stock offer for those Fox assets to $71.3 billion. That tops Comcast's all-cash bid of $65 billion, unveiled a week earlier. Disney had agreed in December to buy a majority of Fox for $52.4 billion in stock.

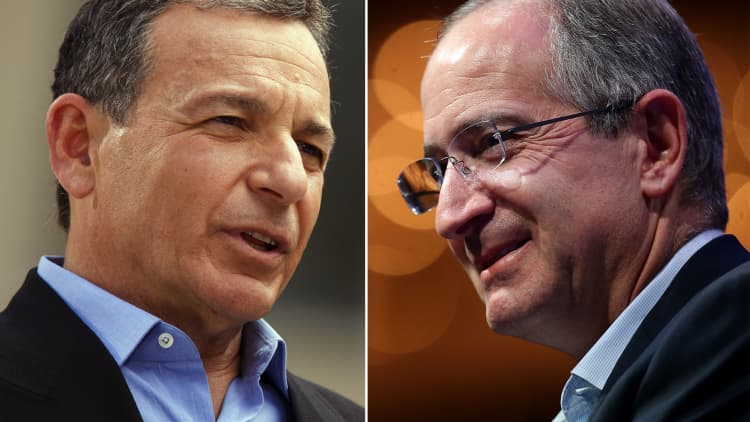

Murdoch favors Disney and CEO Bob Iger even though the offer is stock not cash, Auletta said in a "Squawk Box" interview, adding Murdoch believes Disney is a "stock that will grow."

"Knowing [Comcast CEO] Brian Roberts and knowing the rivalry between he and Disney, he's going to come in with a bid to try and top the last Disney bid," Auletta speculated, but refused to hazard a guess on how high.

If Comcast were to make a new offer, it would test the resolve of Disney, which has a reputation for being "fairly disciplined economically over the years," he said.

Hulu and international 'really matter to both companies'

The assets on offer from Fox include movie studios; television networks National Geographic and FX; Star TV in India; stakes in British pay-TV company Sky and online streaming service Hulu; and regional sports networks.

"What's at stake here are two things that really matter to both companies," Disney and Comcast, Auletta said.

"One thing is Hulu and the ability to compete against Netflix, which scares them all and one of the reasons Murdoch is selling his company," he said.

"The other one is international. Comcast is weak internationally," he said. "Sky is attractive and Star in India is attractive."

To that end, Murdoch is trying to disrupt Comcast’s separate offer for Sky with a new bid valuing the U.K. broadcaster at around $33 billion, the Financial Times reports.

As for India, the world's second-largest internet market, it's considered an untapped jewel, and Netflix and Amazon's video streaming service are going after viewers with series geared to that market.

Roberts and Iger 'won't be sitting at the same table' in Sun Valley

The bidding war for Fox comes as the biggest names in media and tech gather this week in Sun Valley, Idaho, for the annual exclusive business conference run by investment bank Allen & Co.

"This is the Sun Valley Allen & Co. conference. It starts tonight. They're all at an outdoor barbecue," said Auletta. All the players in the Fox drama are coming, but "believe me they won't be sitting at the same table," he added.

The relationship between Roberts and Iger is "polite" but it's a "wave not a hug" type of situation, he said.

— Disclosure: Comcast, which owns CNBC parent NBCUniversal, is a co-owner of Hulu.