Raw materials are getting pricier for General Motors, and a new car could soon cost you more, too.

The nation's largest automaker on Wednesday said it's prepared to pass along a higher-than expected jump in commodity costs this year. The pricier raw materials and unfavorable exchange rates in Brazil and Argentina will cost it $1 billion this year.

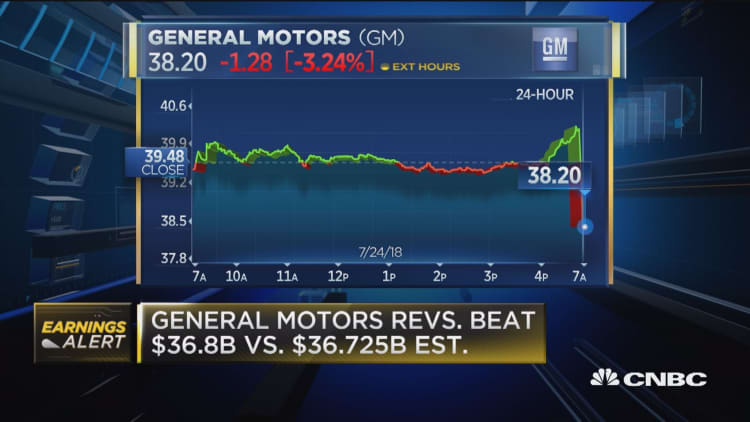

The increase prompted GM to trim its profit outlook for the year, which sent shares plunging. GM stock was down more than 6 percent Wednesday afternoon, on track for its biggest one-day percentage drop since November 2011.

"To the extent that we have opportunistic ability to pass along some [of the higher costs], we will," Chief Financial Officer Chuck Stevens said on a call with analysts.

In an interview earlier with CNBC, Stevens blamed "market forces" for the rise in commodity prices, not the tariffs the Trump administration placed on steel and aluminum this year, specifically. GM buys most of its steel domestically.

The company is able to offset some of the impact of higher costs by selling higher-priced vehicles this year, Stevens said. Consumers' growing taste for larger vehicles like pickup trucks and SUVs has been a boon to GM because these models are more profitable than smaller ones. Other options going forward to handle higher costs include substituting materials, he added.

The auto industry isn't alone in struggling with more expensive commodities, which have hit the bottom lines of companies from washing-machine maker Whirlpool to airlines like Delta and United.

Even though commodity prices have eased from recent highs, GM will still feel more of the impact in the second half of the year because it takes about three months for those high-priced commodities to work their way into the automaker's supply chain, said Stevens.

The auto industry has warned that tariffs could drive up production costs and vehicle prices, resulting in job cuts. The Washington Post reported Wednesday that the Trump administration is considering a 25 percent tariff on $200 billion worth of foreign-made cars, but GM CEO Mary Barra told analysts on the call she could not speculate on the impact. The White House did not immediately respond to a request for comment.