Much of the stock market seems to agree that in the e-commerce industry, there can only be one winner, and that that winner will undoubtedly be Amazon.

But for CNBC's , the truth "is a little more complicated," he said Tuesday. "In reality, online shopping is still a rapidly growing category with room for more than one player."

Big-box chains like Walmart and Target have realized that, the "Mad Money" host said. Both companies have upped their spending on e-commerce and leveraged their brick-and-mortar locations in the process, leading to the rise of "buy online, pick up in store," fondly known in the industry as BOPUS.

So, to see whether these "old-school retailers" can really start taking digital market share, Cramer enlisted the help of technician Tim Collins, his colleague at RealMoney.com.

Walmart

Collins began by inspecting the daily stock chart of Walmart, a long-standing Arkansas-based chain and the parent company of budding Amazon competitor Jet.com.

In the last five months, shares of Walmart have made a rounding bottom pattern, hitting two low points — known as a double bottom among technicians — in the week of May 7 and the week of May 29. Six weeks ago, shares headed higher, with Walmart's stock settling at $89.77 a share as of Tuesday's close.

To Collins, the trend looked like a "pattern within a pattern," Cramer said. Walmart's stock was already trading higher in a tight range, but since the start of July, it has rallied within an even tighter range. That created two floors of support — at $87 and $88 — in addition to the third floor of $82, where the stock bottomed in May.

"According to Collins, this is a great way to define your risk," Cramer said. "If the stock goes below $87, roughly $3 bucks down from where it is, he'd become more cautious; if it breaks down below $82, he'd tell you to abandon the bull thesis and simply cut your losses."

But based on Walmart's latest rally and the Chande Trend Meter, a key indicator that distills a bunch of metrics into a single score, Collins said shares of Walmart are poised to rally.

In fact, if the stock surges past the $90.50 level, "he's betting it'll be smooth sailing all the way up to $103 bucks as it fills in the gap from the big late-February decline," Cramer said.

Target

Next, Collins looked at the weekly chart of Target's stock. Having just made a fresh 52-week high on Tuesday and inching toward its all-time high, the stock seemed to Collins like it was close to being overextended.

Target's full stochastic oscillator, which technicians use to tell whether a stock is overbought or oversold, is in "extremely overbought territory," meaning it could be due for a pullback after a rapid run higher, Cramer said.

"Collins says the stock could get a bit of boost if it breaks out above the ceiling of resistance at $82.50, ... but he doesn't like the risk-reward at the moment," the "Mad Money" host said. "That's why Collins recommends swapping out of Target and swapping into Walmart, which has a lot more room to play catch-up."

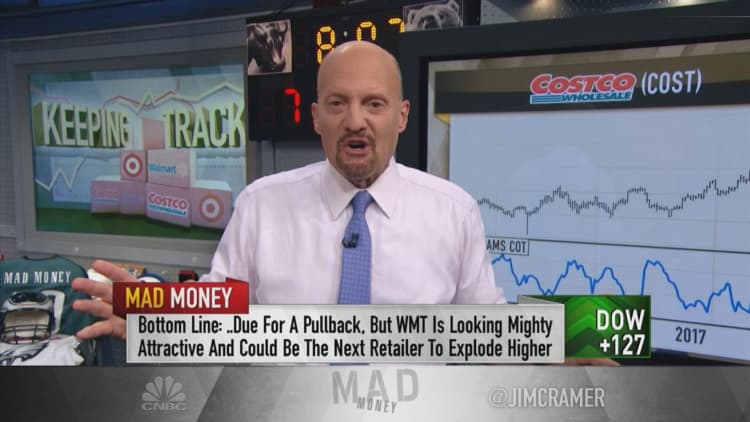

Costco

Cramer also called on IReallyTrade.com's Larry Williams, a renowned technician and the namesake for a number of key indicators, to take a victory lap for his October 2016 call on the stock of Costco.

Back then, Cramer and Williams recommended buying the roughly $150 stock of Costco, which has rallied to $223 and change in less than two years.

"I bring this up ... because [Williams] says it's time to declare victory in Costco and ring the register," Cramer said on Tuesday, pointing to a weekly chart of Costco's Williams COT indicator, a tool technicians use to see how big institutions are trading a given stock.

After Costco's recent rally, the Williams COT has plunged, a sign that major financial players are selling the stock, which was one reason Williams said the stock could be ready for a longer term sell-off.

"My view? Look, I love Costco's membership-based model, I go there all the time, but nobody ever got hurt taking a profit," Cramer said.

"The bottom line? The charts, as interpreted by Tim Collins and Larry Williams, suggest that you might want to sell some Costco and Target here — they've run a lot and they both might be due for a pullback," he concluded. "But Walmart, on the other hand, is looking mighty attractive and could be the next retailer to explode higher."

WATCH: Cramer's charts show Walmart stock ready to rebound

Disclosure: Cramer's charitable trust owns shares of Amazon.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com