The is a day away from a major milestone. Wednesday would mark the longest bull market ever for the index, stretching 3,453 days since hitting a bottom in March 2009.

It may be peaking, said Jim Paulsen, chief investment strategist at Leuthold Group.

Five factors which have powered this bull run -- valuations, investor confidence, rising company profits, low competition from other investments and an economic recovery – appear to have reached their limits, he said.

"It's not any one of those, per se, but it's the fact that all of them are fairly used up," Paulsen told CNBC's "Trading Nation" on Monday. "After the longest bull markets in history, we used up a lot of the capacity to improve things that would help the stock market."

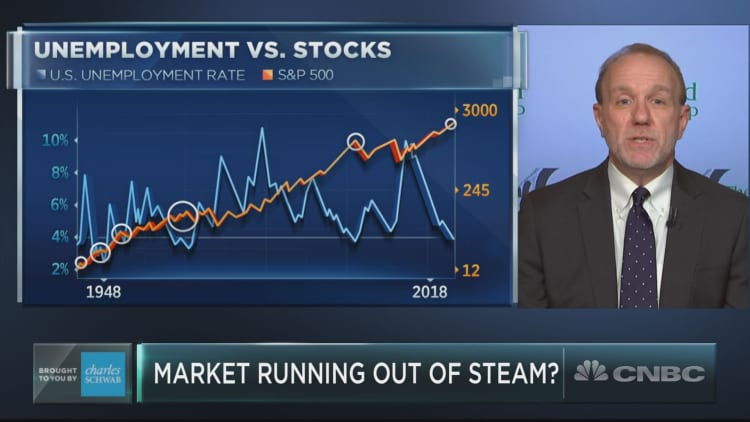

The unemployment rate, acting as a barometer of the economy, is unlikely to get much better, said Paulsen. It currently sits at 3.9 percent, but reached as low as 3.8 percent in May in its lowest reading since 2000. Any reading below 4 percent is historically a negative for the stock market, he said.

"If you go back in post-war history the absolute best returns from the stock market come when you're at the highest labor unemployment rate and the worst returns have come when you're at the lowest labor unemployment," he said.

The unemployment rate has been at or below 4 percent just 14 percent of the time since 1948, according to Paulsen. During those times, the S&P 500 had a forward one-month annualized return of 1.5 percent.

"It's very bleak returns when you're at full employment," said Paulsen. "Part of the reason is, how do you improve job creation, confidence and other things?"

Increased competition from investments outside the stock market could also put an end to this bull market, he said. A rising yield on the 10-year Treasury note, for example, could offer investors an alternative to the stock market. Yields recently moved higher than their 10-year moving average.

"We've just breached it for one of the rare times since this bond bull began in the early '80s," said Paulsen. "For 30 to 35 years it's one of the rare times that yields look high relative to what people might consider their normal level."

The yield on the 10-year note most recently traded at 2.8 percent, though reached above 3 percent in May for the first time since the beginning of 2014.

Paulsen's other factors are also at multiyear highs. The S&P 500's valuation at 17 times forward earnings is nearly in the 90th percentile of post-war history, while corporate profits have reached record highs.