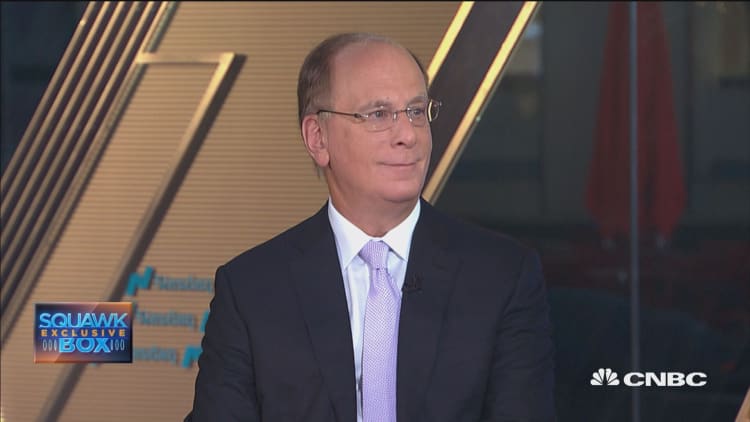

BlackRock Chairman and CEO said Tuesday he saw huge outflows before last week's stock plunge due to "more fear" among investors.

"There's a huge commentary that we are at peak earnings," Fink, CEO of the world's largest money manager, said in a "Squawk Box" interview. He added that commentary is debatable, and his firm expects a "couple more good quarters."

"Companies are having margin pressures because of rising wages, which may be a good thing for the overall economy but not as good for corporate profitability," he said. "Overall, you're seeing more consternation, more fear."

Fink also said most stocks are in correction phase right now.

Wednesday and Thursday saw the heaviest selling of the week, when the Dow Jones Industrial Average plummeted nearly 1,400 points, or more than 5.2 percent, in the two sessions.

The Dow and S&P 500 fell more than 4 percent for the week despite strong gains Friday. The Nasdaq dropped nearly 3.75 percent for the week.

Concerns that the Federal Reserve under Jerome Powell might raise rates more than forecast helped fuel last week's decline. The Fed hiked rates three times this year, and one more is expected in December.

Stock futures were higher on Tuesday as investors looked ahead to a slew of corporate earnings releases.

Earlier Tuesday, BlackRock reported better-than-expected as its assets under management grew by 8 percent on a year-over-year basis. BlackRock has $6.4 trillion assets under management.