Decisions made by OPEC and its allies to manage oil supply should be trusted, said the chief executive of a Russian sovereign wealth fund, adding that he believes that the major oil-producing nations are not interested in having crude prices at "artificially high" levels.

Kirill Dmitriev, CEO of Russian Direct Investment Fund, was asked for his view on U.S. President Donald Trump's latest attempt to influence the policy of the Organization of the Petroleum Exporting Countries.

Trump, in a Twitter post on Monday, said he hopes OPEC "will not be cutting oil production" after Saudi Arabia's energy minister said the cartel and its allies — which includes Russia — may need to reduce output by about 1 million barrels per day. The intergovernmental group reduced its forecast for oil demand in its latest monthly report — its fourth consecutive downward revision to consumption growth for 2019.

"I think we need to trust the decision-making of the joint body because they're not interested in artificially high oil prices. What they want is market stability, which is good for consumers and producers, and this is what we've had over the last several years," Dmitriev told CNBC's "Street Signs" on Wednesday.

"If we work jointly, we would have stable prices now and also stable prices in the future avoiding major shocks," he added.

Trump has hit out at the 15-nation producer group several times on Twitter, blaming OPEC for rising oil prices and ordering its members to take steps to tamp down the cost of crude.

The president's criticisms have resulted in a perception within the oil industry that Saudi Arabia — seen as the de facto leader of OPEC — would comply with Trump's request not to cut crude production, noted Helima Croft, global head of commodity strategy at RBC Capital Markets.

After OPEC lowered its oil demand forecast on Tuesday, crude prices extended their losing streak to 12 straight sessions — ignoring Saudi Arabia's earlier comment of the need to slash output.

"I think the markets are ignoring them ... because of Trump. I think if we didn't have the Trump tweet, there would not be this skepticism. Right now, there's this view that the Saudis will reverse course because of Trump," she told CNBC's "Capital Connection" at the Abu Dhabi International Petroleum Exhibition and Conference.

"What the Saudis need to do is they need to get ahead of this by signaling their intent to see this through," Croft said on Wednesday.

OPEC and its allies began cutting production in January 2017 to drain a global crude glut that sent oil prices from over $100 per barrel to under $30. They are scheduled to meet next month in Vienna, Austria to vote on their next policy decision.

More sanctions on Russia?

Russia, one of the largest oil producers in the world, has been hit by volatile oil prices and tightening sanctions from the U.S. and Europe.

That, together with weakened investor sentiment in emerging markets, has set the Russian currency on a depreciation path this year: One U.S. dollar bought around 67.9043 rubles on Wednesday, compared to 57.6575 rubles at the start of 2018.

As U.S. lawmakers look to push for tougher sanctions on Russia, Dmitriev said he believes those actions would not affect sovereign wealth funds. His fund has $10 billion of reserved capital under management.

"Frankly, we believe additional sanctions on RDIF will be highly unlikely because that would be the first case in the world where a sovereign wealth fund would be sanctioned," he said, explaining that such a move would create a precedent for other sovereign wealth funds to withdraw from the U.S.

"We believe that businesses are against sanctions and sanctions should not be used as an instrument in political discussion," added Dmitriev.

— CNBC's Tom DiChristopher contributed to this report.

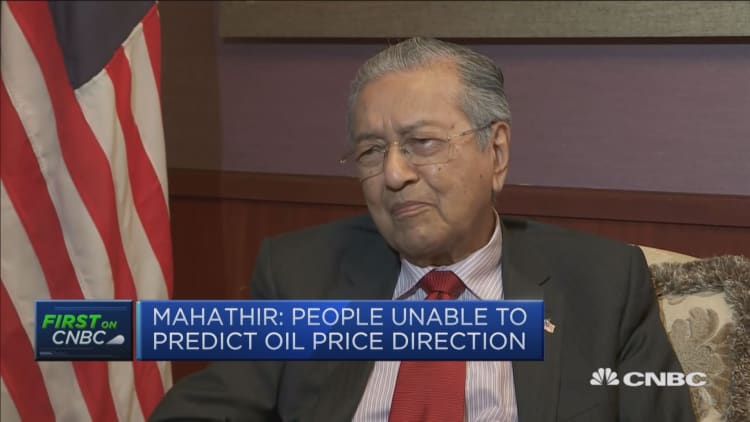

WATCH: OPEC members are 'always at loggerheads,' Malaysia's prime minister says