Goldman Sachs analysts claim that the last 25 years of history shows that the Federal Reserve will stick fast to its current path of interest rate hikes, despite a recent sell-off in stock markets.

U.S. futures suggested there would be a return to buying when markets open Wednesday but global trade tensions and concerns over the tech sector growth have driven "risk-off" sentiment lately. Following Tuesday's session, the Dow and the had lost all gains previously made during 2018.

The underlying U.S. economy is still going strong however, adding 250,000 jobs in October and growing at an annualized 3.5 percent during the third quarter.

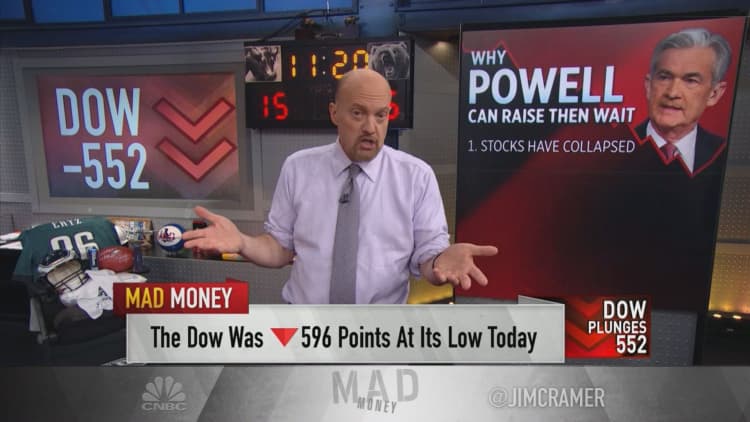

President Donald Trump said Tuesday that he fears rising interest rates could choke off growth and that the Fed should consider reversing course.

"I'd like to see the Fed with a lower interest rate. I think the rate's too high. I think we have much more of a Fed problem than we have a problem with anyone else," Trump said to reporters outside the White House. "I think your tech stocks have some problems," Trump added.

But new analysis from Goldman Sachs suggested that the Fed is unlikely to roll out more accommodative policy just because stocks are tanking.

In a note released late Tuesday and partly penned by Goldman's Chief Economist, Jan Hatzius, the investment bank suggested the Fed would need to see a bigger fall off in U.S. financial conditions before listening to the calls from Trump and others.

"Looking at all significant stock market declines since 1994, we find that the Fed responds with more accommodative policy only when other financial conditions such as credit spreads also deteriorate substantially or when growth is below potential," the research said.

Goldman noted that while credit spreads had widened, suggesting some corporate stress, growth in the United States remained "significantly above potential."

The research said stock market sell-offs had tended to influence the Fed's thinking only if it occurred in tandem with a broader tightening of financial conditions or an atmosphere of weaker growth.

Goldman added that that since 1994 in periods of a market sell-off, cuts to the Fed's funds rate occurred much more often during a U.S. recession or in an immediate recovery from a recession.

The Fed has raised rates three times this year and is expected to hike once more before year-end. Goldman's baseline is that the Fed will raise rates in December and four more times during 2019. The central bank itself has indicated three more rises next year.