The market's fear gauge is signaling that stocks will see less volatility and higher prices in the next few months, CNBC's Jim Cramer said Tuesday after consulting with a top volatility chartist.

The fear gauge, also known as the CBOE Volatility Index or the VIX, tracks option prices to measure near-term expectations of volatility, or the chances that the stock market will endure dramatic swings in the near future. When the VIX rises, it tends to mean investors are growing concerned about the market and making bets to protect themselves.

But the VIX has been trading lower since it peaked in December amid a marketwide sell-off, suggesting that fears about the market are subsiding. To make sense of the action after the late-2018 fallout, Cramer asked technician Mark Sebastian, founder of OptionPit.com and resident "Mad Money" VIX expert, for his input.

Sebastian, who also works with Cramer at RealMoney.com, said that while the nature of the VIX has changed, it's still helpful in predicting what's next for the market. And, right now, it's quite positive, he told the "Mad Money" host.

"Sebastian thinks it signals that this earnings season may be a bit of snoozer, with a bullish bias, as the market gradually pushes higher over the next few months," Cramer said. "The Volatility Index may not be working exactly like it used to, [but that] doesn't mean it's useless, and based on the current action here, he thinks the stock market has more room to run."

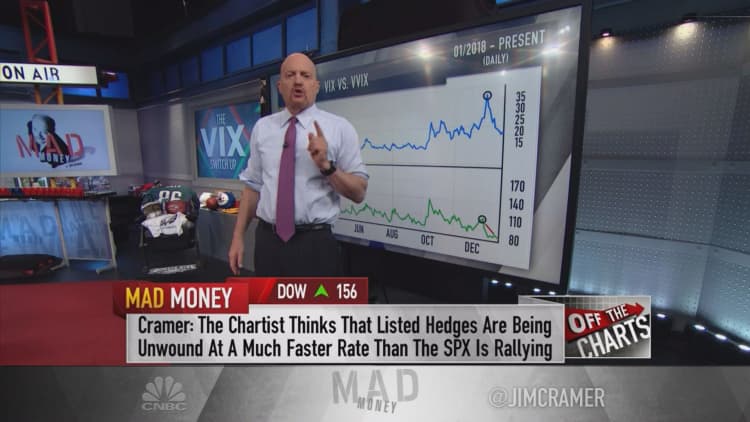

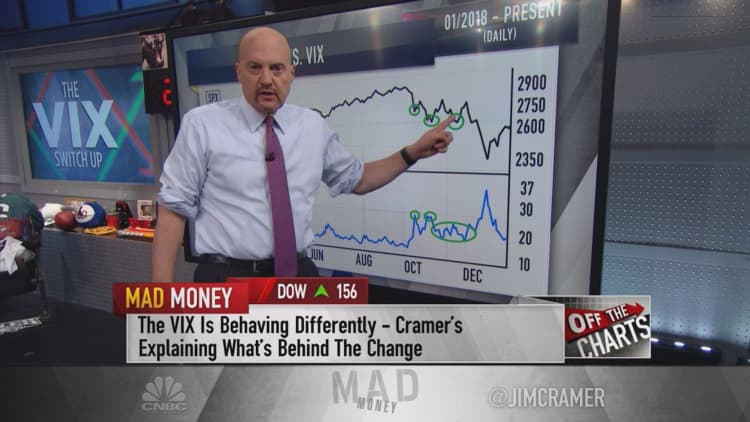

To reach this conclusion, Sebastian reviewed how the VIX acted over the course of 2018. Plotting it against the S&P 500, he noted that during the market's breakdown in February and March, the VIX acted normally: surging when the S&P plunged, and making a lower high when the S&P dropped again, which signaled that the market had bottomed.

But in November, the VIX barely budged when the S&P got crushed, Sebastian said. Normally, that means that stocks are bottoming, but in December, the S&P collapsed again. The VIX only lifted in late December, after the S&P had fallen several hundred points, and didn't even reach its January peak despite the fact that the entire market was selling off.

"Sebastian says the fourth-quarter decline was different from anything else we've seen in the last decade. Since 2008, when the stock market experienced a major sell-off, that's always been accompanied by a huge spike in the VIX," Cramer explained. "If you were only looking at the fear gauge, it seemed to be saying that the garden-variety sell-off at the beginning of last year was worse than the total meltdown at the end of last year."

And, according to Sebastian's analysis, the trading instruments that Cramer railed against in February — the ones that profit when the VIX does down — were behind the unusual action.

Specifically, securities like the VelocityShares Daily Inverse VIX Short-Term exchange-traded note, or the XIV, which imploded while the VIX stayed calm, "[represent] a sea change in how volatility is going to work going forward," Cramer said.

"The crazy price action from a year ago left a bad taste in traders' mouths," he explained, adding that fewer money managers are likely to hedge their positions using VIX options after seeing 2018's swings.

"In this new environment, hedge funds will no longer be racing to cover their short positions, which means that the VIX is probably going to signal that there's less volatility going forward," Cramer continued.

But that doesn't mean that the VIX has become a less useful measure, Sebastian argued. The VIX's tepid action in late December and early January was likely a precursor to the higher prices stocks are currently enjoying, he suggested.

So, as more money managers steer clear of risky VIX trading products and more still unwind their hedges, the fear gauge's recent breather is signaling a peaceful few months ahead for stocks, Sebastian said.

Cramer's take? "Even though I'm a little flummoxed that the VIX really didn't work, I agree with Sebastian. I think we go higher."

WATCH: Cramer's charts suggest less volatility in coming months

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com