A full 43 percent of Californian voters, and an astounding 61 percent of those aged 18 to 34, feel they can't afford to live in the state, according to a recent Quinnipiac University poll. And over three-quarters of voters agree that there's a "housing crisis."

The median value for a house in the Golden state is about $550,000, according to real-estate website Zillow. That's more than twice the national median.

The median monthly rent for an apartment in California is $2,750, which is also about 1.75 times the national median.

But it may not just be housing that's causing residents to feel strapped. Other research suggests it's the cost of living overall.

Quinnipiac University poll, Feb. 6, 2019

In a poll that aimed to "pinpoint what's causing the worst financial fears and stress among Americans," California residents said their top financial stressor was the general cost of living. Respondents could choose between "debt," "health care," "housing," or "taxes," as well as "education," including college expenses, "everyday costs," including groceries and utilities, or "family," including child care and divorce.

And a whopping 91 percent of residents in the Bay Area say the cost of living there is either "somewhat" or "very" high, a poll from data firm YouGov shows. Some experts warn that the situation there may only become more extreme.

It's no wonder so many residents in California and elsewhere are having a hard time. Americans' budgets are tight: A recent survey from financial website Bankrate found that only 39 percent have enough savings to cover a $1,000 emergency. A similar survey from the Federal Reserve found that 40 percent of adults couldn't cope with a $400 emergency.

Middle-class incomes have shrunk in nearly every state, according to data from the Pew Research Center and the Census Bureau, and U.S. households just experienced the biggest decline in net worth since the financial crisis.

Meanwhile, housing costs keep increasing. Home values in California have ticked up 4 percent in the past year and research suggests they could rise another 7 percent within the next year.

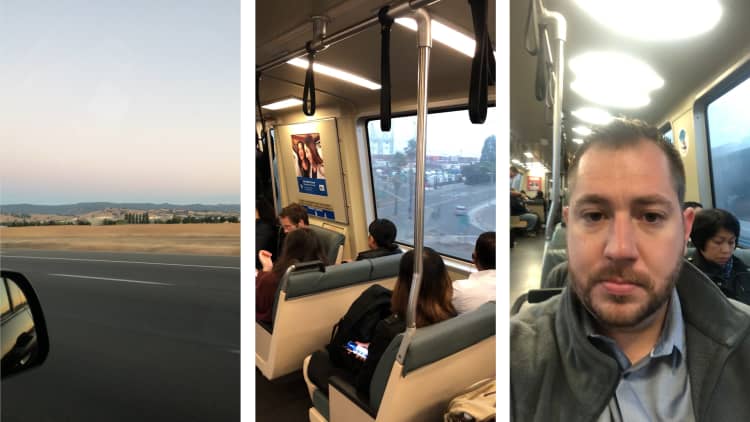

These costs have led some workers like Danny Finlay, an account executive at public relations firm SutherlandGold, to come up with elaborate alternatives: He commutes four hours and 140 miles each day from Dixon, California, to San Francisco for work.

Some residents have resorted to living in "crappy old storage rooms" that have been converted into apartments, while others have resorted to sleeping in their cars. Nationwide, a growing number of young people are living at home and more married Americans are living with roommates.

If you're looking to cut back on living costs, experts suggest these common-sense budgeting tactics and making sure you're doing your best to live within your means. Here are some tips that could help you save and build wealth.

Like this story? Subscribe to CNBC Make It on YouTube!

Don't miss: A shocking number of Americans live in housing they can't afford, according to Harvard study