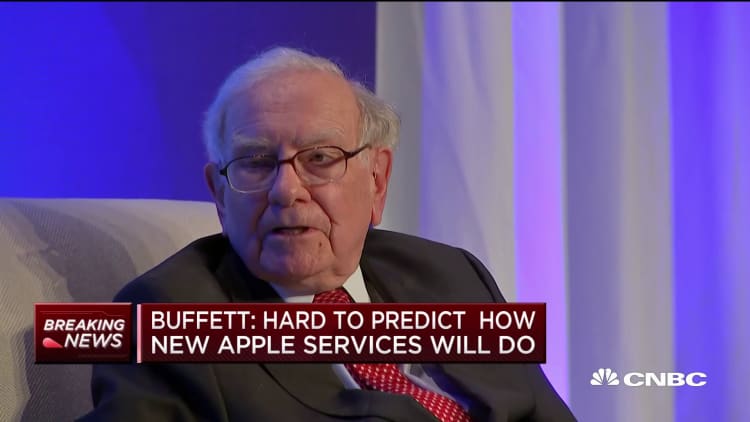

Berkshire Hathaway Chairman Warren Buffett sounded skeptical of Apple's recent push into the streaming TV business during a talk Thursday at The Gatehouse's Hands Up for Success luncheon.

"I'd love to see them succeed, but that's a company that can afford a mistake or two," Buffett said when asked about Apple's recent entertainment announcement. "You don't want to buy stock in the company that has to do everything right."

He continued, "Apple should do some things that don't work."

Apple is Berkshire's largest investment, though it reduced its stake in the company late last year. Buffett said Berkshire owns 5.5 percent of Apple.

Buffett's skepticism around Apple's TV business is because the number of hours that viewers spend on content is limited by the number of hours of the day, he said. Plus, there are several large tech and media companies already investing heavily in the space.

"You've got some very big players who are going to fight over those eyeballs," Buffett said.

"You have very smart people with lots of resources trying to figure out how to grab another half-hour of your time," Buffett continued. "I would not want to play in that game myself."

On Monday, Apple announced new streaming services including a platform for users to subscribe to "channels" like HBO or Showtime, as well as its own service called Apple TV+ featuring Apple-produced content.

Apple's services, which do not launch until later his year, enter a crowded field including competing products from Netflix, Hulu, Amazon and Disney.

"Ten years from now, when we look at entertainment delivery, it will be what people want. It will be in the form they want," Buffett said. "It's going to be a very, very big, hotly contested game, and the one thing I can guarantee is that the public will be the winner."

Last year, Apple became the first public U.S. company to reach $1 trillion in market value. Buffett has previously said that his interest in Apple shares is not because of the company's short-term finances, but because he believes it has a strong brand and ecosystem.

On Monday, Apple also announced an Apple-branded credit card in conjunction with Goldman Sachs and Mastercard.

"Everybody in the world wants to control payments," Buffett said, noting that Berkshire owns about 18 percent of American Express.

Buffett also showed off his cellphone in the interview. It was not an iPhone. Instead, it was an older flip phone.

Disclosure: Comcast, which owns CNBC parent NBCUniversal, is a co-owner of Hulu.