If you're looking for a new home in an urban area, you might be attracted to some more up-and-coming areas.

But buyer beware: Some of those areas come with big risks.

That is according to a new study from GOBankingRates, which evaluated cities based on multiple criteria: percentage of homes with mortgages in negative equity, foreclosure rates, delinquency rates on mortgage payments, homeowner vacancy rates and rental vacancy rates. The site then ranked 40 cities according to these risks.

To be sure, many areas of the country are holding steady. Separate research from CoreLogic, a provider of property information, data and analytics, released in March found that delinquency and foreclosure rates overall were the lowest since 2000.

More from Personal Finance:

Here are the most and least affordable cities to live in

Residents in this metro area saw taxes rise by more than $2,600

Do this when mortgage shopping and save $430 (in interest)

"You could see this as a list of bargains. But if things don't improve, you're just going to lose equity on your house," said Andrew DePietro, lead researcher and data analyst at GOBankingRates.

On top of the list is Newark, New Jersey, which also came in first with highest delinquency rate and highest homeowner vacancy rate.

Other Northeast cities to make the list include Baltimore; Bridgeport, Conn.; Hartford, Conn.; Philadelphia; and Syracuse, New York.

Midwestern cities were also prominent, including Chicago; Cleveland; Dayton, Ohio; Detroit; Toledo, Ohio; Akron, Ohio; Milwaukee; and Rockford, Joliet and Aurora, all in Illinois.

Southern cities also rounded out the top 40, including Birmingham, Alabama; Columbus, Georgia; Jacksonville, Florida; Memphis; Mobile, Alabama; New Orleans; and Norfolk, Virginia, among others.

Tulsa landed on the bottom of the list, but that doesn't necessarily mean it's a safe bet, DePietro said. That's because it still has above-average foreclosure rates, homeowner vacancy rates and rental vacancy rates.

"There are probably suburbs outside these cities that are in less danger," DePietro said.

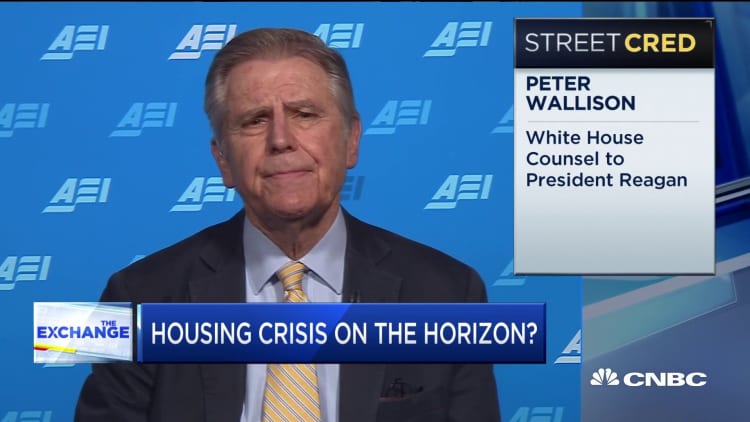

Not everyone agrees that there is trouble on the horizon for these areas.

"There is a broad housing shortage in America," which includes most of the cities named, according to Lawrence Yun, chief economist at the National Association of Realtors.

Because that means there are more buyers than homes for sale on the market, Yun said he does not see prices declining in those areas.

"I think it's a price appreciation in most of those markets," Yun said. "The only way it may reverse is if there's an economic recession with substantial job cuts. But at least through 2019, it looks like it's going to be a continuing job creating economy."

Following are the 40 cities that could be in danger of a housing decline this year, according to GOBankingRates. GOBankingRates used data from the Census Bureau, RealtyTrac and Zillow to complete the study.

40 cities that could see a housing decline

| Rank | City | State |

|---|---|---|

| 1 | Newark | New Jersey |

| 2 | Detroit | Michigan |

| 3 | Bridgeport | Connecticut |

| 4 | Baltimore | Maryland |

| 5 | Hartford | Connecticut |

| 6 | Paterson | New Jersey |

| 7 | Cleveland | Ohio |

| 8 | Fayetteville | North Carolina |

| 9 | Dayton | Ohio |

| 10 | Montgomery | Alabama |

| 11 | Columbia | South Carolina |

| 12 | Birmingham | Alabama |

| 13 | Toledo | Ohio |

| 14 | New Haven | Connecticut |

| 15 | Columbus | Georgia |

| 16 | Akron | Ohio |

| 17 | Macon | Georgia |

| 18 | Philadelphia | Pennsylvania |

| 19 | Rockford | Illinois |

| 20 | Newport News | Virginia |

| 21 | Chicago | Illinois |

| 22 | Hampton | Virginia |

| 23 | Norfolk | Virginia |

| 24 | Syracuse | New York |

| 25 | Joliet | Illinois |

| 26 | Little Rock | Arkansas |

| 27 | Mobile | Alabama |

| 28 | Jacksonville | Florida |

| 29 | Saint Louis | Missouri |

| 30 | Miami Beach | Florida |

| 31 | New Orleans | Louisiana |

| 32 | Lansing | Michigan |

| 33 | Aurora | Illinois |

| 34 | Miami | Florida |

| 35 | Memphis | Tennessee |

| 36 | Savannah | Georgia |

| 37 | Milwaukee | Wisconsin |

| 38 | Tallahassee | Florida |

| 39 | Bakersfield | California |

| 40 | Tulsa | Oklahoma |

Source: Source: GOBankingRates