Golden State Warriors fans paying attention to Chevron's recent analyst meeting might have had a sense that something big was coming from the Bay Area oil giant.

San Ramon, California-based Chevron hosted the annual meet-up about a month before announcing its massive $33 billion deal to purchase Anadarko Petroleum, a driller with a large position in the red hot Permian Basin in western Texas.

During the event, Wells Fargo analyst Richard Read asked how Chevron is evaluating opportunities to grow its own footprint in the Permian, the top U.S. shale oil field. Chairman and CEO Michael Wirth took the question, drawing on an analogy he said he had recently used to describe his Permian strategy.

"We're from the Bay Area. After the Golden State Warriors won a couple of NBA titles, they added Kevin Durant to try to get better, and they added DeMarcus Cousins," Wirth said.

"When you're doing well, it doesn't mean you're going to stop there," he continued. "And so, I think we need to get better. We're big, so bigger is not necessarily an imperative. I think better is something that you're always looking to do."

Like a hoops star making a no-look pass, Wirth then abruptly tossed to another analyst (though Read blocked the attempt and asked another question).

Fast forward several weeks, and Wirth used almost the same language to describe the deal with Anadarko on a conference call.

"It's not about getting bigger in the Permian," Wirth told analysts. "It's about getting better in the Permian, and I think this makes us better in the Permian."

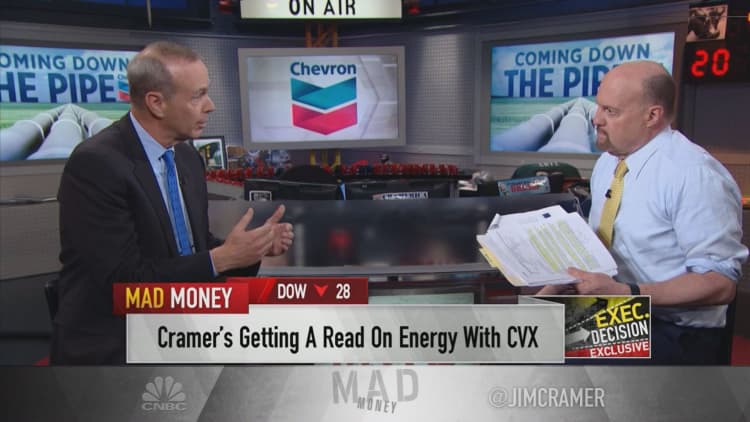

One person that also considers Anadarko an MVP: CNBC's Jim Cramer. On Monday, Cramer called the deal "very smart" and a "game changer." Cramer holds shares of Anadarko in his charitable trust and has long held a positive view on the driller.

In an interview on CNBC's "Mad Money," Wirth told Cramer the Permian will continue to be a major source of U.S. oil production for years, if not decades.

"We're right now drilling hundreds of wells. We see thousands and thousands of well locations and multiple benches that we'll be able to drill," he said, referring to the stacked rock formations that characterize shale basins.

"And the technology does continue to get better. The practices get better, and we see a lot of running room in the Permian."