CNBC's Jim Cramer suggested Friday that investors add three more 5G plays to their basket of stocks, given the current state of the market.

"In a confusing market, you should always be ready to fall back on your favorite long-term themes, and right now the 5G buildout is one of the best," the "Mad Money" host said. "And VMWare, Silicon Labs and Marvell Tech are now three more great ways to play it."

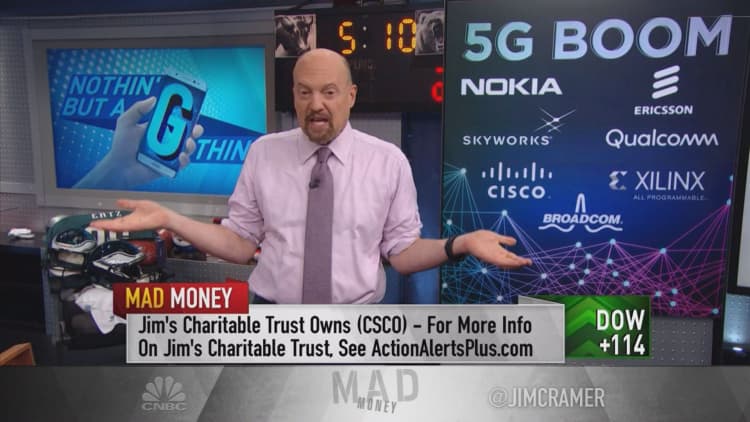

At the end of April, Cramer listed Qualcomm, Skyworks Solutions, Broadcom, and Xilinx among the best chipmakers to benefit from the rollout of the fifth generation of wireless technology. He also recommends Nokia and Ericsson as a play on telecommunications infrastructure. On the networking equipment front, Cisco Systems has exposure to the space, Cramer said.

A slew of other phone and technology companies will spend billions of dollars in coming years on the 5G buildout that is expected to offer faster download speeds and cellular connections that match that of Wi-Fi, he noted. Even after a week of extreme market volatility, stocks that have multi-year growth themes are names worth gobbling up, he added.

"We're going back to the 5G well because, well, it's just such a great story and there are just so many different ways to play it," he said. "These are exactly the kinds of stocks that are worth buying into a market-wide moment of weakness, like we had today, and while the worst of the latest decline may be behind us, know that hell week's over, there's always gonna be another sell-off."

VMWare

One of the leading suppliers for cloud infrastructure and data center, VMWare has big exposure to 5G, Cramer said. The virtualization technologies company offers an easy way for wireless carriers to upgrade their networks, he added.

VMWare provides a way for networking slicing, where multiple virtual networks can be run on the same 5G hardware, Cramer pointed out. Additionally, the company has become the "quintessential infrastructure" for the 4G-to-5G transition landing deals with Vodafone, AT&T, and Ericsson, COO Sanjay Poonen told Cramer in a recent interview.

Cramer called VMWare "best of breed" in software-defined infrastructure.

"As telco companies build networks that need to run on both 4G and 5G hardware, they need VMWare to ensure a smooth transition and get the most out of the big buildout," Cramer said. "Even without 5G, this is a terrific company, but now it's got one more awesome kicker."

Silicon Labs

Silicon Laboratories has a ton of exposure in various sectors including the so-called internet of things, communications, automotive and industrial control products. A number of analysts downgraded the stock in January after the semiconductor company delivered a disappointing quarterly report and bleak forecast.

Still, the equity was too cheap at $80 per share near the end of March, Cramer said. Since then, it has rallied to finish above $101 per share in Friday's session, thanks in large part to its plans for 5G, he noted, pointing to CEO Tyson Tuttle's projection that wireless infrastructure revenue will more than double in 2019.

The company still has more headwinds to address, particularly in China, but 5G has given Silicon Labs a new outlook on the future.

"Apparently four of the world's top five wireless infrastructure makers are already using their chips for the 5G rollout," Cramer said. "Plus, it doesn't hurt that Silicon Labs pulled back hard this week. It's currently down 9 bucks from its highs, thanks to the recent semiconductor sell-off. I think it's a bargain, now."

Marvell Tech

Marvell Technology has a lot of mobile exposure, but its $6 billion acquisition of microchip designer Cavium placed the company among the top suppliers for 5G infrastructure, Cramer said. The consumer semiconductor products producer is now a good play on 5G, cloud, artificial intelligence, enterprise hardware and automotive industries, he said.

Samsung inked a long-term deal with Marvell to get processors for its 5G base stations. On top of that, Marvell's leadership expects 5G sales to pick up at the end of the fiscal year and to keep growing thereafter.

Cramer said the stock is trading at a discount, at 9% below its recent highs. The company reports earnings in coming weeks.

"I wouldn't be surprised if Marvell ends up delivering an upside surprise," Cramer said. "Feel free to put on a small position beforehand, but even if the stock gets hit, I would be a buyer into weakness."

WATCH: Cramer adds three more 5G plays to his basket

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com