Slack Technologies' reference price was set at $26 per share, the New York Stock Exchange announced Wednesday evening.

That does not necessarily mean Slack's Class A shares will open at $26 when they make their stock market debut on Thursday.

A reference price is not an offering price. It is also not an opening price. That number will ultimately be determined by the designated market maker, based off a calculation of a figure where buy orders can be met with sell orders.

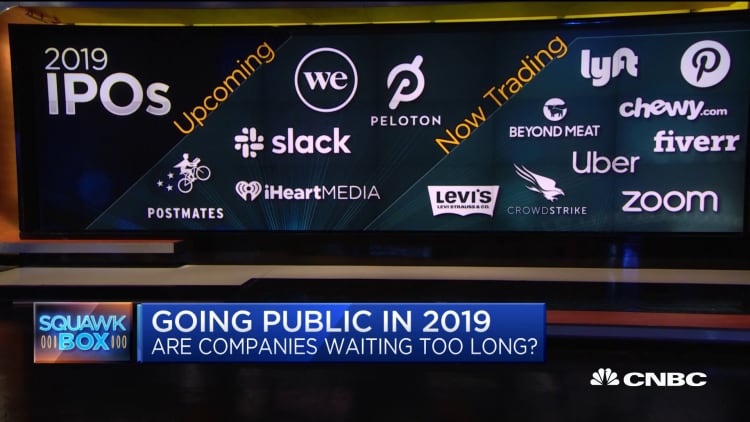

Like music streaming service Spotify, Slack decided to pursue a direct listing, rather than a traditional initial public offering. This allows existing investors to sell into the public markets, but the company won't be offering shares or raising fresh capital.

Slack, the maker of a popular team messaging service for businesses, will trade under the ticker symbol "WORK."

For the year ending Jan. 31, the company reported a net loss of $138.9 million on $400.6 million in revenue, according to documents it filed in April.