President Donald Trump has decided not to intervene in U.S. currency markets after convening Cabinet officials and top level economic advisors Tuesday to discuss the issue, according to Larry Kudlow and two other people familiar with the meeting.

Two senior administration officials, who declined to be named, said the primary discussion at the meeting of trade principals was on ways to weaken the dollar. Kudlow, Treasury Secretary Steven Mnuchin, Trade Representative Robert Lighthizer, Agriculture Secretary Sonny Perdue, deputy chief of staff Chris Liddell, trade advisor Peter Navarro and Council of Economic Advisors chief Tomas Philipson attended the meeting.

"He says, 'There's a problem — what are we going to do about it?'" said one of the officials, referencing Trump's long-running frustration with currency strength, which he sees as an impediment to closing trade deficits.

Among the ideas debated, the officials said: Implementing capital controls — an idea viewed as extreme by most participants in the meeting – or having Mnuchin and Kudlow actively "jawbone," or talk down, the dollar on television.

Navarro had advocated for intervention but didn't make it through 10% of his presentation, according to a senior official. The anti-interventionists in the room were "armed to the teeth," this person added.

People briefed on the meeting said it broke without a decision to pursue a concerted new currency policy. They acknowledged, however, that the president hopes media appearances continue to help his cause.

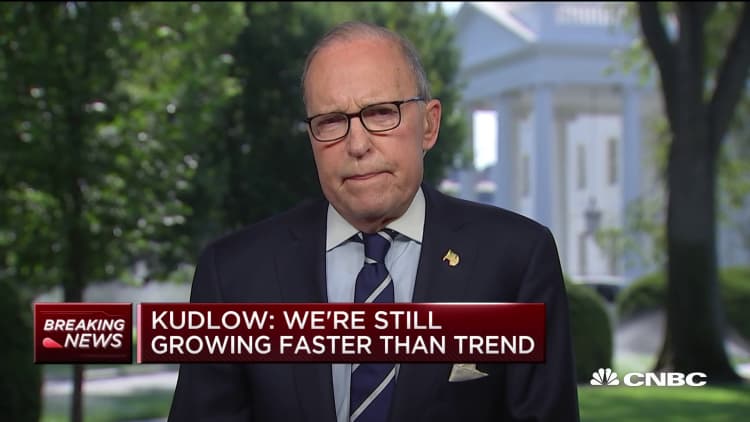

Mnuchin, who opposes market intervention, and Kudlow, who has touted the value of a strong dollar throughout the course of his career, appeared on CNBC and acknowledged the issue. Kudlow confirmed White House principals opted not to intervene during a recent meeting.

"What the president is concerned about is foreign countries may be manipulating their own currencies lower to try to gain some short-term temporary trade advantage. That we do not like," Kudlow told CNBC. "But it's not a question of bringing down the dollar."

Mnuchin told CNBC on Wednesday that, while Treasury secretaries traditionally have extolled a strong dollar at all times, "a stable dollar is very important. And over the long-term period of time — again, the long term — I do believe in a strong dollar."

However, pressed by CNBC anchors as to whether he shares the president's penchant for a weaker currency at present: Mnuchin clarified, "I am not going to advocate a weak dollar policy near term as Treasury secretary."

The West Wing's anti-interventionist voices have been able for more than a year to keep the president's impulses on currency at bay. This week, tensions flared between Navarro, a well-known hardliner within the administration, and Philipson, the White House's newly appointed CEA chair, who vehemently voiced a desire to let the market forces behave independently of administration action, the officials said.

The question of currency intervention is coming into closer focus as the Federal Reserve prepares to meet next week and potentially lower interest rates.