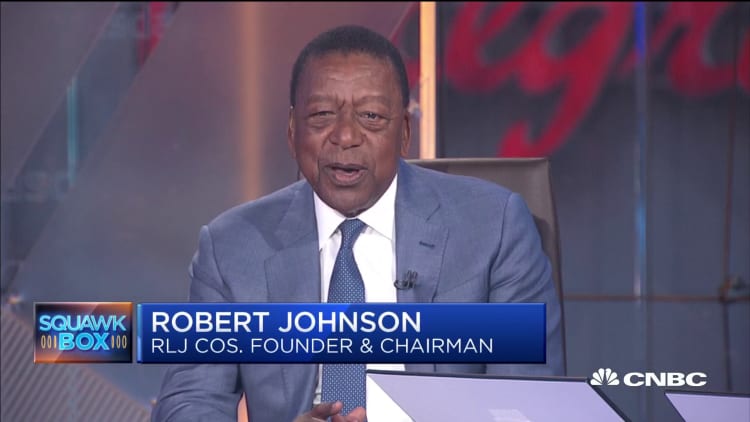

Entrepreneur and media mogul Robert Johnson told CNBC on Thursday that ultimately he's glad he avoided investing in e-cigarette companies that pitched themselves to him about five years ago.

"I didn't want to have my name associated with cigarettes," said Johnson, who started The RLJ Companies investment firm after selling BET in 2001. "20/20 hindsight, we made the right decision and looked for other places to put our money."

Vaping firms often market themselves as healthier alternatives to traditional cigarettes, and as a way that adults can wean themselves off of the habit. Some research does back up those claims.

However, e-cigarettes would later prove attractive and addictive to teenagers. To combat the teen vaping epidemic, the Food and Drug Administration is finalizing guidance to remove all non-tobacco flavors of e-cigarettes.

Johnson, who said he never a smoker, said the argument for vaping several years ago was to create and invest in something with "the perception of good qualities" and to get in on the startup industry. "They presented a very good business model."

Despite thinking he would get a good return if Big Tobacco bought into the e-cigarette world, Johnson said, "There was something about it that made me say, we're going to pass on this."

Johnson was correct in his prediction that major tobacco companies would become interested in vaping. Last December, Altria, the tobacco giant Marlboro and other popular cigarette brands, invested $12.8 billion for a 35% stake in Juul, valuing the wildly popular, San Francisco-based vaping startup at $38 billion.

Since launching in 2015, Juul has quickly come to dominate the e-cigarette industry with roughly 40% of the market. But Juul has also become ground zero for critics who claim the company got teens hooked on vaping with flavors such as mango and creme.