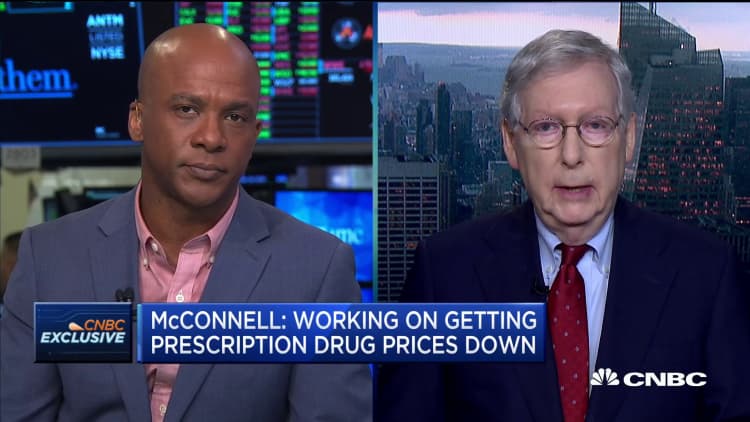

Restricting Chinese investment in the U.S. may not be the best playbook for dealing with China, according to Senate Majority Leader Mitch McConnell.

The Kentucky Republican played down any benefits of preventing Chinese companies from tapping into U.S. stock markets, and said it would not be in the best interest of the U.S economy.

"That could end up hurting us — whatever tactics we use with regard to China need to not be ones that punish us," McConnell told CNBC's "Squawk Alley" Monday. "We're worried about the Chinese and their involvement in this country in some respects, but the Treasury Department made it clear they're not interested in delisting Chinese companies from U.S. stock exchanges."

The White House is looking into curbing some U.S. investments in China, a source familiar with the matter told CNBC last week. That could include removing Chinese stocks from U.S. exchanges, and limiting government pension funds' investments in the Chinese market. The reported move was widely seen as an effort to gain leverage in the upcoming U.S.-China trade talks.

White House economic advisor Peter Navarro dismissed the idea as well in an earlier CNBC interview, saying that reports suggesting that might happen are "fake news." Chinese Foreign Ministry spokesman Greg Shuang also told reporters Monday that any delisting moves "will harm the interests of Chinese and American companies and people, create turmoil in financial markets, and endanger global trade and economic growth," according to Reuters. Shuang also said he was told by Treasury that there were no plans to block listings "at this time."

Trade talks are scheduled to resume on Oct. 10 in Washington. Over the past year and a half, both countries have levied billions-of-dollars-worth of tariffs on each other's goods.

The U.S. Treasury assistant secretary for public affairs said in a statement over the weekend that "the administration is not contemplating blocking Chinese companies from listing shares on U.S. stock exchanges at this time. We welcome investment in the United States."

The U.S. government added Huawei to the Entity List in May, meaning American companies could no longer do business with the Chinese manufacturer. McConnell said they were "concerned about Huawei" but that the U.S. had to balance that with our commercial interests."

"We don't want to make it more difficult for American companies to do business in China and for Chinese companies to do business here, but these national security implications are important," he said.