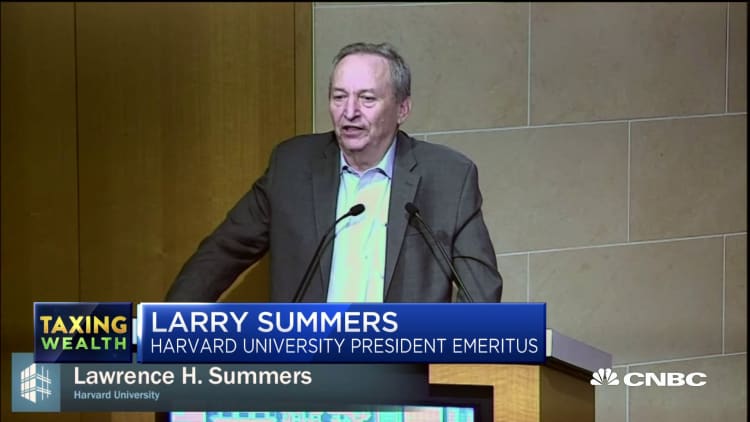

Former Treasury Secretary Larry Summers, one of the economic pillars of the Democratic establishment, lashed out at the idea of a wealth tax, saying it was bad economics, bad policy and built on bad data.

Speaking at a Peterson Institute panel on inequality in Washington on Thursday, Summers said that the type of wealth tax being proposed by Democratic candidates Elizabeth Warren and Bernie Sanders was leading progressives down the wrong path to try to solve inequality. Summers' criticisms suggest that the wealth tax is splitting the Democratic Party, between a moderate wing that wants to raise taxes on the wealthy through capital gains rates and closing loopholes, and a rising faction of the party that wants bolder solutions like the wealth tax.

"For progressives to invest their energy in a proposal that the Supreme Court has better than a 50% chance of declaring unconstitutional," he said, "that has very little chance of passing through the Congress, whose revenue potential is extraordinarily in doubt — for that to be the defining element in the progressive agenda in the United States, it seems to me to potentially sacrifice an immense opportunity."

Summers took special aim at the two economists – Emmanuel Saez and Gabriel Zucman – who have been advising the two senators on their wealth taxes. He said a wealth tax would likely raise less than half of the $200 billion in revenue projected by Saez and Zucman.

He said the data behind Zucman and Saez's widely reported claim in their new book that the top 400 richest Americans pay a lower rate than the bottom 50% is "substantially inaccurate and substantially misleading." To prove the point, he said he applied their algorithm to his own tax return to calculate his wealth and "it was not within a country mile – either in toto or on a category-by-category basis."

Summers also said that rather than reduce the political power of the rich, a wealth tax could increase the influence of money in policy by driving more of the fortunes of the rich into charitable causes and nonprofits that reflect their personal views and causes.

He said it costs the rich only $4 million or $5 million a year to become a top donor to either the Republican or Democratic Party so imposing a wealth tax on billionaires and mutlimillionaires won't reduce their reach.

"A wealth tax is not going to stop the wealthiest people in American from being able to come up with a vast multiple of $4 million to $5 million," he said.

At the panel with Summers, Saez admitted that "our numbers may be wrong," but that people could read their book to decide.

In an email to CNBC, Zucman said: "We've produced the best estimates we could using currently available information and state-of-the-art methodologies. But our methods are certainly not definitive — they will be improved in the future, just like all economic statistics constantly are."

Asked about Summers' comments that the wealth tax was a missed opportunity for progressives, he said, "Politics is changing in America and the wealth tax is extremely popular, so it may well happen too."