The grounding of the 737 Max after two fatal crashes continues to drag on, frustrating airline executives as the carriers miss out on close to $1 billion in revenue this year alone.

Southwest Airlines, the largest U.S. operator of the Max, said the grounding cost it $210 million in revenue in the last quarter, $435 million in revenue in the first nine months of the year, and said it expects the "the damages to grow into 2020."

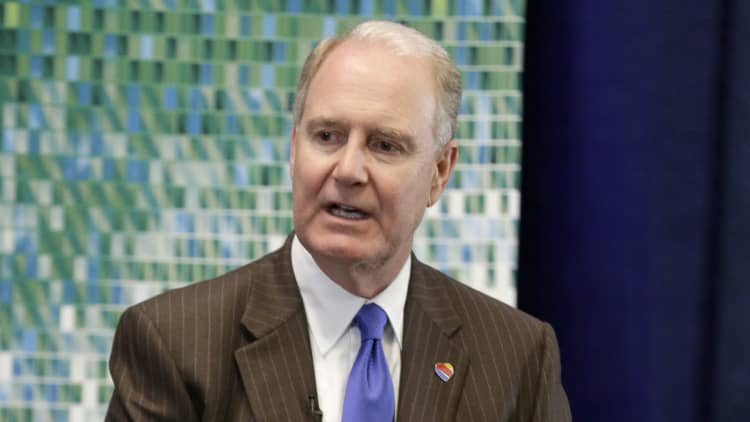

"We're not happy about our situation," CEO Gary Kelly told CNBC's "Squawk on the Street" on Thursday.

Southwest, which had 34 Max planes in its fleet at the time of the grounding, more than any other U.S. airline, posted stronger profit and revenue in the important third quarter, which includes the summer travel season. But the grounding crimped sales and dashed its capacity growth plans. Southwest expects to receive about 75 Max planes from Boeing next year when the grounding is lifted but the timeline is uncertain.

"We put our future in the hands of Boeing in the Max and we're grounded," Kelly said. "I want to settle with Boeing to settle our damages."

Kelly said Southwest, which operates only single-aisle Boeing planes, would consider other types of planes, but he has said such an complicated undertaking would take years.

Boeing has shared with regulators some software fixes for its beleaguered bestselling aircraft after a flight-control system was implicated in a Lion Air crash in Indonesia in October 2018 and an Ethiopian Airlines crash in March. Regulators, however, haven't signed off on the changes yet. Steve Dickson, administrator of the Federal Aviation Administration, said at an industry conference on Tuesday that it hasn't finished evaluating things such as human factors to determine whether the planes are safe and that the process would take several more weeks.

"We've got considerable work to do to get there," Dickson said.

American Airlines on Thursday said the grounding, now in its eighth month, would reduce its pretax income by $540 million this year, up from an estimate of $400 million it made in July. The carrier reported higher-than-expected earnings, while revenue came in at $11.91 billion slightly lower than Wall Street estimates.

American's CEO, Doug Parker, said he wants to make sure the carrier is compensated for the disruptions. American, Southwest and United have canceled thousands of flights because of the grounding and scrambled to change to other aircraft to meet passenger demand. Airlines have repeatedly delayed when they expect the plane to return to their schedules but currently no U.S. airline is planning for their return until at least January.

Boeing in the second quarter took a $4.9 billion after-tax charge to compensate airlines but the final cost is unknown as the grounding continues, the company said Wednesday.

"We're working to ensure that Boeing shareholders bear the cost of Boeing's failures, not American Airlines' shareholders," Parker said on an earnings call.