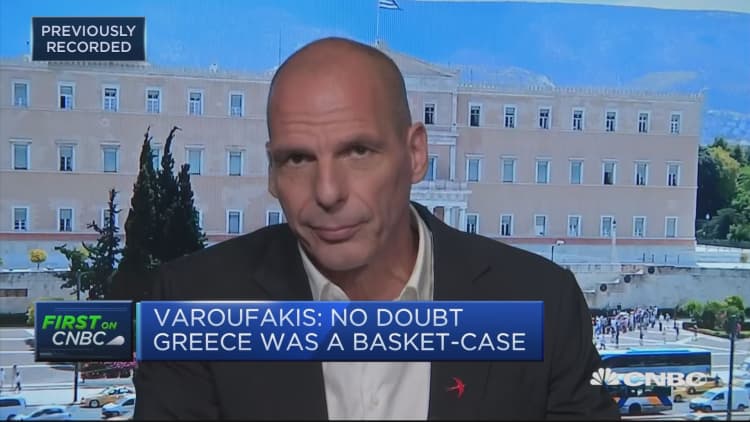

The European Central Bank (ECB) needs to reinvent itself and come up with new policy tools as its bond-buying program is no longer effective, Yanis Varoufakis, Greece's former finance minister told CNBC Thursday.

The ECB has been under intense criticism for announcing a new round of quantitative easing (QE) in September — whereby the central bank purchases government bonds, leading to lower yields (borrowing costs for governments) across the euro zone. When yields on European government bonds rise, countries have to pay more to finance themselves and service their debts, thus hurting balance sheets.

Some active ECB members criticized the decision to announce a second round of QE without a clear end date. Certain members said it's at risk of breaching its self-imposed purchase limits and potentially facing legal challenges.

"QE the way it has been restructured resembles an antibiotic that has stopped working because the bacteria have grown adapted to it," Varoufakis, who was the Greek finance chief during the height of its debt crisis, told CNBC.

The ECB unveiled its first huge stimulus package in 2015, in a bid to revamp the euro zone economy following the 2011 sovereign debt crisis. That asset purchase program was then extended further on different occasions and ended in December last year.

However, inflation — the main focus for the ECB — has failed to pick up to the bank's target of "close but below 2%." As a result, it announced its new round of QE in September, with monthly purchases set to reach 20 billion euros ($22 billion).

Otmar Issing, a former chief economist at the ECB, was also dismissive of the move, telling CNBC on Wednesday: "This does not make, in my mind, any sense."

"It will not have positive effects, but it will have negative effects," he said.

One of the potential negative impacts of QE is that the additional money supply it creates may not achieve its ultimate goal: increasing bank lending and boosting investment.

Furthermore, QE could also ultimately lead to a devalued currency — meaning that imports would become more expensive. Speaking to CNBC, Varoufakis argued that the incoming ECB President Christine Lagarde will have to "develop new instruments."

"The ECB should issue its own bond," he said.

A euro-wide bond would include debt from different countries, mixing, for instance, Italian and German debt. The latter is perceived as a less-risky asset than Italian bonds and mixing the two is seen as controversial in some corners of the continent.