Wall Street is counting on a breakthrough in U.S.-China trade negotiations, but CNBC's Jim Cramer isn't banking on it.

President Donald Trump, again, on Friday teased that the U.S. was nearing a trade agreement with China, while Chinese President Xi Jinping signaled that Beijing also wants to land a deal but would "fight back" if necessary.

"I don't think it's the end of the world if there's no breakthrough in the trade talks, but I recognize that people are getting a little too confident we're going to get a deal," the "Mad Money" host said. "Of course, a deal is always possible, but the longer the stock market stays up, the less likely it is that we'll get one. A strong market means President Trump has more leverage to hold out for better terms."

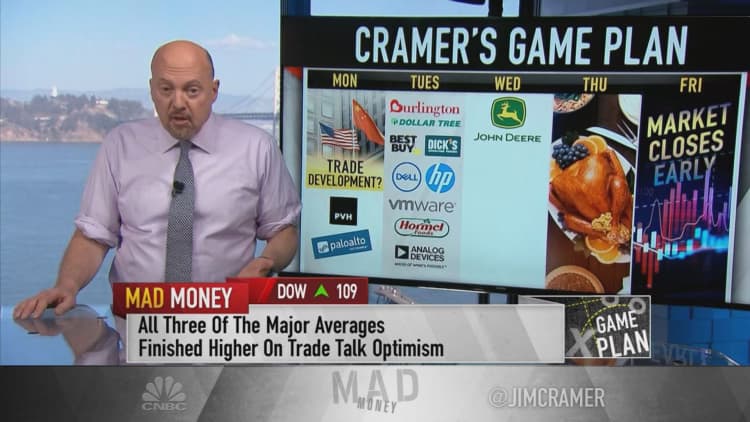

The major averages all broke multi-day losing streaks in Friday's session — posting gains of as much as 0.39% — and snapped multi-weekly win streaks amid trade uncertainty. With a holiday around the corner, Wall Street will have a shortened week of trading. The stock market will be closed on Thanksgiving Day Thursday and will close at 1 p.m. on Friday.

There will, however, be a full slate of earnings reports coming out in the days prior. Cramer gave viewers an overview of what he has circled on his calendar.

"After Wednesday we eat turkey and on Friday we eat leftovers knowing there's an unwritten rule that nothing important is supposed to occur on Wall Street," the host said. "Will the president slaughter a turkey this year, or slaughter the market? I bet he goes for the former."

Monday: PVH, Palo Alto Networks

PVH plans to release its third-quarter report before the market opens. Wall Street expects the fashion holding company, which owns brands like Van Heusen, Tommy Hilfiger and Calvin Klein, to show $2.99 earnings per share against $2.5 billion of revenue, according to FactSet.

"When you hear about weakness in department stores, that often causes weakness in PVH's wholesale business," Cramer said. "They've seen some real strength in Europe, though, but will that be enough – enough to offset the mall? Let's find out."

Palo Alto Networks is out with its first fiscal 2020 earnings report after the closing bell. The cybersecurity firm is expected to bring in $768 million in revenue and return $1.03 per share to stockholders. Cramer warned investors to "be careful here."

"Last time, Palo Alto's stock dropped precipitously after the headline numbers came out, then it soared as we got more color," he said. "That's why I always tell you to wait for the conference call before you jump to any conclusions."

Tuesday: Burlington, Dollar Tree, Best Buy, Dick's Sporting Goods, Dell

Burlington Stores reports earnings in the morning. Analysts consensus pegs earnings at $1.40 per share and revenue at nearly $1.8 billion of revenue, FactSet said.

Dollar Tree also reports quarterly numbers before the morning bell. The discount chain and Family Dollar parent is projected to do $5.7 billion in sales and turn in $1.13 EPS.

Best Buy is expected to produce $9.7 billion in revenue and $1.03 of profit per share when it reports before the market opens, according to analyst consensus in FactSet.

Dick's Sporting Goods has an earnings report coming out in the morning. FactSet forecasts $1.9 billion of revenue and 38 cents per share.

"I want to hear about how they're going to benefit from Nike's decision to stop selling its goods on Amazon," Cramer said.

Dell reports third-quarter results after the market closes. Analysts expect $1.74 EPS and more than $23.8 billion in revenue.

HP, which is being targeted by Xerox for an acquisition, is set to report its final quarterly performance for the 2019 fiscal year. The computer processing hardware maker is estimated to show nearly $15.3 billion in revenue and 58 cents of earnings per share.

VMware has an earnings release after the closing bell. Shareholders of the cloud computing software manufacturer, which Dell has a majority stake in, can expect $1.43 EPS and $2.4 billion of revenue, according to FactSet.

Hormel Foods releases its fourth quarter fiscal 2019 results before the market opens for trading. The food producer is expected to report 46 cents in profit per share and exceed $2.5 billion in revenue.

Analog Devices delivers its fourth quarter fiscal 2019 results in the morning as well. The chipmaker is estimated to produce nearly $1.5 billion of revenue and $1.22 earnings per share.

Wednesday: Deere

Deere has an earnings release coming out before the stock market opens for a half day of trading on the eve of Thanksgiving. Wall Street is looking for nearly $8.5 billion of revenue and $2.14 of earnings per share.

"Wall Street seems to love Deere no matter what," Cramer said. "Because the trade war is a win-win situation for Deere. Either we get a deal and our farmers get lots of orders, or we get no deal, that business goes to Brazil and our farmers get bailed out by the government because we're headed into an election year."

Disclosure: Cramer's charitable trust owns shares of Amazon.com

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com