The merger of International Flavors & Fragrances and DuPont's nutrition and biosciences unit will create a company with double the research and development of any of its rivals, DuPont's chairman said.

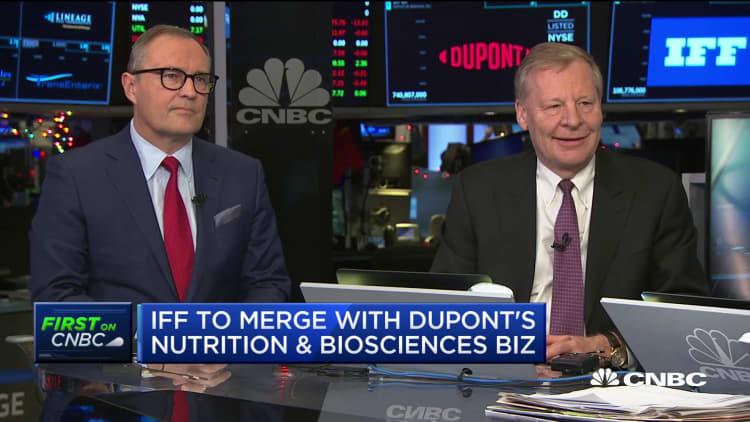

"This creates the global leader across all the ingredients spaces. It's the broadest portfolio by far, and we'll have double the R&D of any other company in the industry," DuPont Executive Chairman Ed Breen said Monday on CNBC's "Squawk on the Street."

IFF announced the deal Sunday. Breen said two other companies were also bidding for the DuPont division. The deal is expected to take 12 to 13 months to close and will create a $45 billion consumer giant.

Meat alternatives are one area that could benefit from the strength of the new company's R&D division. DuPont produces the plant-based proteins used in meatless alternatives, while IFF creates the flavors and colors.

Shares of IFF, which has a market value of $13.4 billion, are down more than 7% Monday afternoon. DuPont's stock, which has a market value of $48.3 billion, were up less than 1%.

Under terms of the agreement, DuPont shareholders will own 55.4% of the shares of the new company and existing IFF shareholders will own 44.6%, IFF said in a statement.

Industrial materials maker DuPont will also receive a one-time cash payment of $7.3 billion upon closing of the deal, IFF added.