The U.S. energy secretary does not believe the ultimate impact of China's fast-spreading coronavirus is a cause for concern for markets.

His comments come shortly after both OPEC and the International Energy Agency (IEA) dramatically lowered their oil demand growth forecasts this year as a result of the deadly flu-like virus.

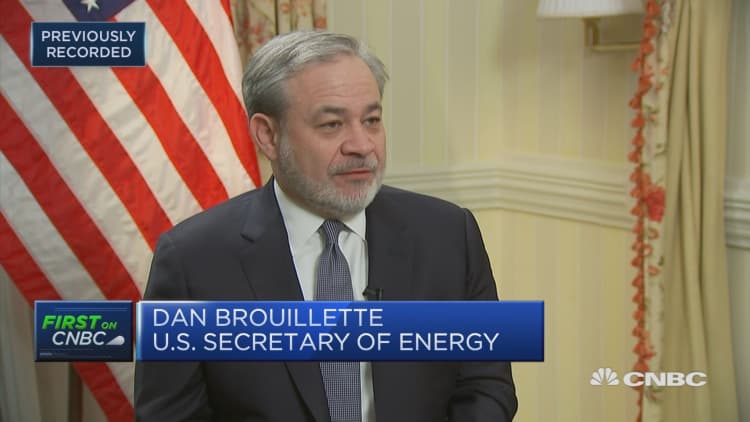

"I think we are going to pay close attention to what is happening with the virus itself. We are still analyzing, not only the actual virus to learn more about it, but also the response to it," Dan Brouillette told CNBC's Hadley Gamble in an exclusive interview on the sidelines of the Munich Security Conference on Friday.

"So, we are looking to see if the Chinese government will be able to contain or at least help contain the spread of the virus. At this moment, while we are seeing some slight reductions in production as a result of the virus, we are not yet concerned about its ultimate impact."

International benchmark Brent crude traded at $56.40 Friday morning, up around 0.1%, while U.S. West Texas Intermediate (WTI) stood at $51.49, around 0.15% higher.

Both crude benchmarks have fallen nearly 20% since climbing to a peak in early January, dragged lower by concern over demand in China during the coronavirus outbreak.

Earlier this week, OPEC slashed its demand outlook for oil demand growth this year, citing China's coronavirus outbreak as the "major factor" behind its decision.

The Middle East-dominated producer group downwardly revised its 2020 outlook for global oil demand growth to 0.99 million barrels per day (bpd) on Wednesday. That's down by 0.23 million bpd from the previous month's estimate.

The IEA has also cut its 2020 oil demand forecast, predicting 0.825 million bpd this year — the lowest since 2011.

When asked why the U.S. was not more concerned given that both OPEC and the IEA had both lowered their oil demand growth expectations this year, Brouillette replied: "We have to put these things into context."

"We have to put together very, very tough measures to contain the virus and if we do that effectively then I think you'll see the markets bounce back and you'll see the economies continue to grow."

OPEC meeting

Led by Saudi Arabia, OPEC had pushed for an emergency meeting with non-OPEC partners earlier this month in order to cut oil production to offset the impact of the virus.

A committee advising the group, which consists of some of the world's most powerful oil-producing nations, reportedly recommended a 600,000 bpd reduction in oil production to bring relief to the energy market.

However, Russia is still considering whether to sign up for the additional cuts, more than one week after the recommendation.

OPEC's regular meeting is set for March 5. An earlier meeting than scheduled is still possible, but there has been no announcement.