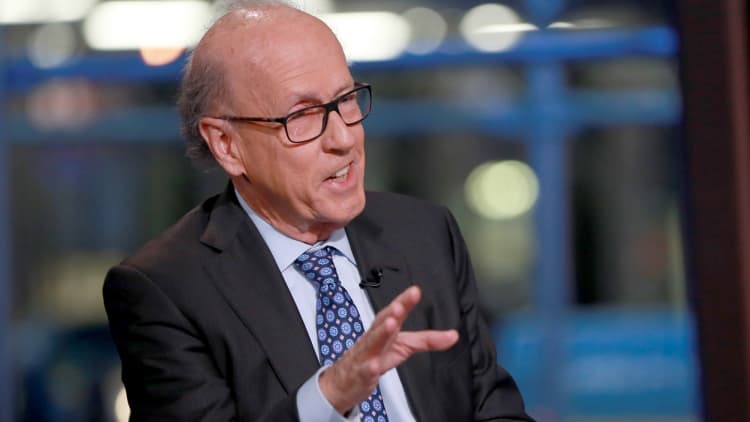

The coronavirus may significantly weaken a global economy that was already in a precarious position, Yale University's Stephen Roach told CNBC on Wednesday.

"If the global economy is as weak as I think it is in the first half of this year, that points to a pretty serious reckoning for frothy financial markets," the former Morgan Stanley Asia chairman said on "Closing Bell."

Roach's warning Wednesday comes hours after the International Monetary Fund's leader called the coronavirus "most pressing uncertainty" for the world economy. Goldman Sachs also warned that for markets "risks of a correction are high."

Investors have been trying to make sense of what the coronavirus means for businesses since late January. And yet, the market has only seen a few pullbacks in that stretch as the major U.S. stock indexes continue to set fresh highs.

The S&P 500 and Nasdaq Composite posted record highs Wednesday. The S&P 500 is up 4.8% so far this year, while the tech-heavy Nasdaq is up 9.4%.

Roach said the markets continued move to the upside despite coronavirus uncertainty does not make sense because "irrational exuberance never makes sense."

"As long as central banks are opening up the liquidity spigot as wide as they are, the markets pay absolutely no attention to any potential threats to economic activity," Roach said. "It's the here and now, and it works until it doesn't."

Roach said the coronavirus outbreak carries increased financial risk due to the state of the global economy entering 2020.

He previously pointed to the IMF's estimate of 2.9% global growth in 2019, writing in a piece for Yale that it had "slowed into the danger zone."

"The world was only about 0.4 above the global recession threshold," he said Wednesday.

And since the IMF published that figure in January, Roach said more sour economic data has emerged. Japan may have fallen back into recession, he said, and Germany and France reported poor December industrial output figures.

"With Europe and Japan and China in trouble, the U.S. certainly will not once again be the oasis the market seems to think it will [be] in 2020," he said.