The recent stock market meltdown may have dented Americans' retirement savings, but there's a silver lining: The downturn made one common retirement strategy less costly for investors.

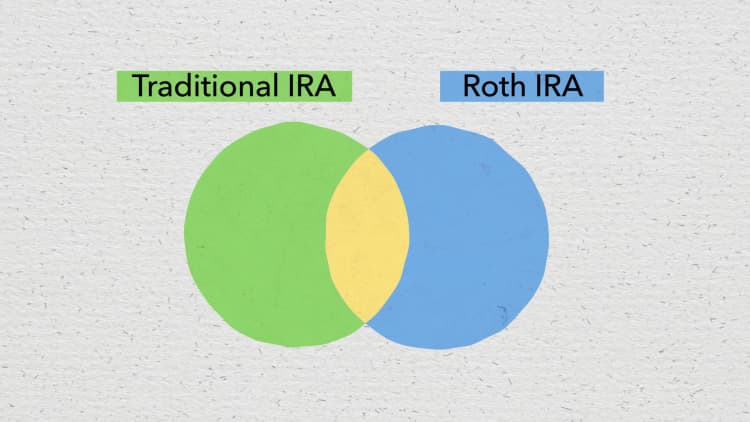

The strategy, known as a Roth IRA conversion, involves changing a traditional, pre-tax retirement account — such as a 401(k) plan or a qualified individual retirement account — to an after-tax Roth fund. This strategy has some unique benefits when compared with its traditional cousin.

To do the conversion, savers would opt to pay income tax now, while markets are down and tax rates are lower under the Tax Cuts and Jobs Act.

Of course, savers shouldn't peg a Roth-conversion decision solely to stock-market gyrations — doing so would be like trying to time the market, which is a fool's errand, experts said.

The stock market's sell-off over the past two weeks, driven by fears of the coronavirus' spread in the U.S. and around the globe, means many investors could get a better tax deal on their Roth conversion.

That's because investors would be paying tax on a smaller investment portfolio, meaning they'd pay less tax overall.

"You want the best deal, like when you buy anything," said Ed Slott, CPA and founder of Ed Slott & Co. in Rockville Centre, New York. "You want it on sale and at the lowest price."

Investors who own traditional accounts defer income tax on their savings until withdrawing the money in retirement. Roth savers pay tax up front and don't pay later.

Having at least some Roth funds is beneficial for a few reasons, according to financial advisors.

Retirees don't have to take mandatory withdrawals from Roth accounts, unlike traditional IRA investors, who have to beginning at age 72. Taking Roth distributions could also decrease Social Security taxes and Medicare premiums, which are pegged to one's taxable income.

In addition, there's the benefit of tax diversification. Like the concept of investment diversification, tax diversification is important because it reduces the risk associated with unknown future tax rates, advisors said.

Data suggest investors aren't greatly diversifying their retirement accounts from a tax standpoint.

Traditional IRAs held around $7.5 trillion at the end of 2018 — almost 10 times as much as Roth accounts, which had $800 billion, according to the Investment Company Institute.

We're basically at about the lowest tax rates we've ever seen in the country.Jamie Hopkinsdirector of retirement research and v.p. of private client services at Carson Group

Here's an example to show why the stock market's recent selloff could benefit investors looking to do a Roth conversion.

Let's say a single taxpayer had a $1 million IRA invested in an S&P 500 mutual fund, and converted the entire account to a Roth around two weeks ago. The person would have paid more than $334,000 in federal income tax to do the conversion. (This example assumes no other income for the year.)

If the taxpayer had converted a week later — after the S&P 500 lost 11%, for its worst week since the 2008 financial crisis — the person's tax bill would have been around $41,000 less.

"It's better to convert assets when they're low in value than when they're high in value," said Jamie Hopkins, director of retirement research and vice president of private client services at Carson Group, a financial advisory firm based in Omaha, Nebraska.

The stock market has seesawed back and forth this past week, with the Dow Jones Industrial Average market index jumping more than 1,000 points on both Monday and Wednesday and diving more than 900 points on Thursday.

Ultimately, investors should peg a conversion primarily to tax rates — if savers believe their tax rate is lower now than it will be in retirement, a conversion makes sense because it will cost less in the long run, according to tax experts. And, contrary to popular opinion, one's tax rate doesn't always fall in retirement, they said.

Tax rates are currently low by historical standards and are likely to increase (rather than fall further) in the future, experts said, given the eventual need to raise federal revenue to reduce the U.S. budget deficit, which is larger as a share of its economy than most other developed countries.

Income tax rates are also scheduled to increase in six years (back to 2017 levels) under the Tax Cuts and Jobs Act.

The low tax environment and recent stock market dip offer a double benefit for investors considering a Roth conversion, experts said.

"We're basically at about the lowest tax rates we've ever seen in the country," Hopkins said. "I think almost every single person should be converting money to Roth accounts in 2020."

Roth conversion strategy

Investors can hedge their bets by doing a series of annual Roth conversions rather than converting a large chunk of their account all at once, Slott said.

An efficient way to do this, experts said, would be to try "filling up" income-tax brackets with Roth conversions.

For example, a single taxpayer with $100,000 of taxable income would be in the 24% income-tax bracket. The taxpayer could convert around $63,000 to Roth money without creeping into the next-highest bracket of 32%.