Goldman Sachs' top U.S. stock strategist said Wednesday that the longest U.S. bull market in history will meet its demise soon, with equities seeing significant losses beyond what they've already suffered over the last three weeks.

David Kostin, chief U.S. equity strategist at Goldman, wrote that the historic fall in interest rates is unlikely to prevent a "collapse" in second- and third-quarter profits, and he advised clients to tilt investments toward companies with stable earnings and strong balance sheets.

"After 11 years, 13% annualized earnings growth and 16% annualized trough-to-peak appreciation, we believe the S&P 500 bull market will soon end," Kostin warned in a note. "Investors have cut their equity positions in recent weeks, but not to levels reached at the trough of other major corrections this cycle."

The stock strategist slashed his midyear S&P 500 forecast to 2,450, meaning the investment bank now sees the market falling another 15% beyond Tuesday's close to levels not seen since December 2018. That is, the bank now sees the market down another 15% on top of its 14% loss incurred over the last month.

Kostin did say, however, that he expects a rebound in the back half of 2020 to boost the S&P 500 to 3,200 by year's end, 11% higher from current levels.

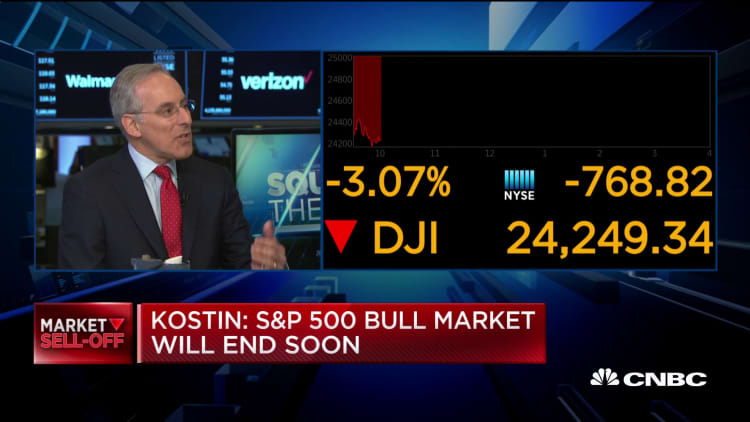

The S&P 500 and Dow Jones Industrial Average are down more than 14% from all-time closing highs hit in February. Investors have punished stocks around the world in recent weeks as the coronavirus spreads around the globe and threatens workplace productivity.

Some worry that the impact to output could be so severe that it could tip some economies into a recession, an acute source of volatility for the market, which hasn't posted a daily move of less than 1% since February. The Dow posted its worst day since the 2008 financial crisis on Monday with a decline of more than 2,000 points only to halve those losses on Tuesday with a near-5% rally.

"Both the real economy and the financial economy are exhibiting acute signs of stress," Kostin wrote.

"Supply chains have been disrupted and final demand has declined for many industries. Travel is contracting sharply as both individuals and businesses restrict movement," he continued. "Airlines, hotels, cruises, and casinos report plunging demand, lower occupancy, and cancellations. Employees are being furloughed."

But losses in the stock market that have accompanied broader concerns over the economy have varied widely by industry.

Kostin, for example, said his forecast for weaker 2020 earnings hinges on lower oil prices and interest rates that "diminish Energy and Financial company profits." Those two sectors have underperformed the broader stock market even amid its March sell-off as a plummet in crude prices whack energy stocks and a swoon in long-term interest rates threaten bank margins.

"Domestic business activity outside of those sectors is also likely to be weaker than we originally forecast, as underscored by reduced or withdrawn guidance from a number of firms in recent weeks," Kostin added.

The Energy Select Sector SPDR exchange-traded fund, which tracks the performance of the largest energy producers in the U.S., is down 23.9% this week after OPEC failed to persuade Russia to cut oil production. Those failed talks, in turn, sparked a 25% decline in the price of West Texas Intermediate crude and a steep sell-off in energy.

Occidental Petroleum and Marathon Oil are the two worst-performing stocks in the S&P 500 over the last month, each down in excess of 60%.

A plunge in long-term interest rates to record lows sent ETFs that track big U.S. banks spiraling, with the SPDR S&P Bank fund down 30% this year. J.P. Morgan and Citi are down 27% and 30%, respectively, in that period.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.