Pershing Square manager Bill Ackman turned a net profit of more than $2 billion on Monday after he sold his bets against the market less than one week after warning CNBC that "hell is coming" and imploring the White House to shut down the country for a month

He then used those proceeds to wager that existing Pershing bets, including hotel operator Hilton Worldwide, would rebound.

Ackman said the fund completed the exit from his bets against the market on March 23 and generated $2.6 billion compared with premiums paid and commissions totaling $27 million. The amount of capital Ackman put behind protecting credit — the actual principal wagered against the market — is unknown.

Still, the Ackman about-face came less than one week after he told CNBC's Scott Wapner in an emotional interview that the United States was in jeopardy unless President Donald Trump closed the country for one month in a sort-of "Spring Break."

"America will end as we know it. I'm sorry to say so, unless we take this option," he told CNBC on March 18, five days before ending his bet against the market. "We need to shut it down now. ... This is the only answer."

That Ackman added to his Hilton position using the money he earned from his bets against the market is notable, especially given the grim forecast he issued for equity last week. He first announced his hedges against the market on March 3.

"It's going to zero along with every other hotel company in the world. ... Every hotel is going to be shut down in the country. Every one," he said at the time. "Again, I'm a major shareholder. [But] if we allow this to continue the way we allow it to continue, every hotel company in the world is done."

Novogratz tweet: "Please get Ackman off CNBC before people start jumping off bridges. @CNBC"

Though some, like ex-hedge fund manager Michael Novogratz, blamed Ackman for stoking the market's panic, the Pershing Square manager said in his Wednesday letter that the outlook for equities had changed in a material way over five days.

"The federal government and the U.S. Treasury have intervened in financial markets in an unprecedented fashion, and the Congress is on the brink of passing legislation which will help bridge the economy and our country's workforce and citizens during what we believe to be a temporary but massive economic shock," Ackman wrote.

For those reasons, "we became increasingly positive on equity and credit markets last week, and began the process of unwinding our hedges and redeploying our capital in companies we love at bargain prices," he added.

Ackman said he used the influx of cash to add to Pershing's existing investments in Agilent, Berkshire Hathaway, Hilton, Lowe's and Restaurant Brands. The fund also purchased "several new investments including reestablishing our investment in Starbucks," which it had closed in January.

The billionaire investor explained that Pershing's market hedges included credit protection on various investment-grade and high-yield credit indexes. Ackman said that since Pershing was able to purchase the hedges at near-all-time tight levels of credit spreads, the risk of loss was "minimal."

That bet proved prescient ahead of one of the worst market sell-offs in the modern era as the S&P 500 and Dow Jones Industrial Average plunged more than 30% through Friday from their recent highs as the coronavirus and measures to contain its spread worried economists that the U.S. economy is headed toward a recession.

The spike in volatility and steep equity losses have in turn forced the Federal Reserve to embark on a host of massive easing programs to help calm stressed credit markets. The central bank announced Monday that it will purchase corporate bonds and not just U.S. Treasurys, providing unprecedented support for investment-grade corporate debt.

But for Ackman, the coronavirus remains a calamitous problem that he thinks will continue until the U.S. government locks down the country for one month.

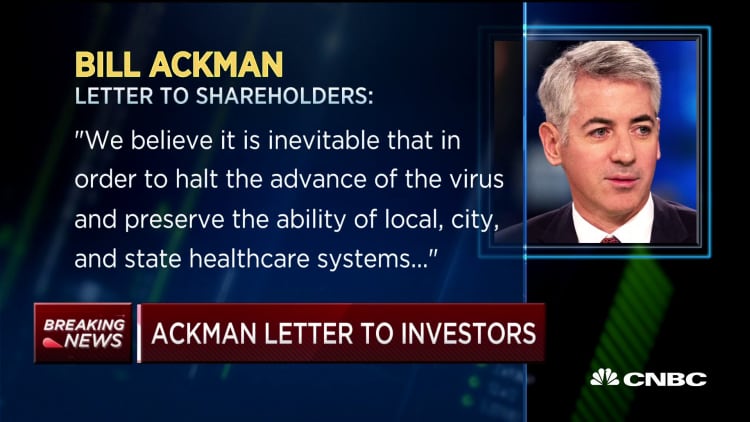

"We believe that the federal government will soon initiate a total-US shutdown with a defined reopening date about 30 days later," Ackman wrote Wednesday. "If the federal government does not impose such a lockdown, we believe it is likely that effectively all fifty states will do so eventually, with the additional delay costing many thousands of more lives, and much greater economic destruction."

Ackman also revealed to CNBC's Scott Wapner he went into lockdown almost a month ago to save the life of his father, who is immuno-compromised.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.