The coronavirus pandemic is putting an end to the longest economic expansion in U.S. history.

After expanding for a record 126 months as of December, economists now predict GDP growth will plummet in the first and second quarters of the year as businesses shutter and hundreds of millions of Americans are locked down.

"This is a huge, unprecedented, devastating hit," former Federal Reserve Chair Janet Yellen told CNBC on Monday, adding she expects GDP to tumble 30% year on year in the second quarter.

Dire unemployment and growth forecasts have led some to compare the coronavirus downturn to the Great Recession from 2007 to 2009 or the Great Depression in the 1930s. However, policymakers say this recession is unlike any other in U.S. history because it was spawned by a health crisis, not by an unhealthy economy.

"I would point to the difference between this and a normal recession: There is nothing fundamentally wrong with our economy," Federal Reserve Chairman Jerome Powell told NBC's "TODAY" last month.

'Extraordinary disruption'

Unemployment was at a 50-year low, economic growth was steady around 2% and stock markets were at record highs in February. Then the coronavirus brought entire parts of the U.S. economy to a standstill in record time.

One March survey of companies in the services sector, which includes restaurants, bars and hotels, showed the steepest decline in economic activity on record. "Alternative data" like public transit traffic, satellite imagery or restaurant reservations paints an equally grim picture.

"This is an extraordinary disruption," said Diane Swonk, chief economist at Grant Thornton. "It's almost like a meteor hit the entire planet and we have to now deal with the fact that we've been knocked off our axis."

As businesses across the country have shut down to comply with stay-at-home orders, workers have been laid off at an unprecedented pace. In the final two weeks of March alone, nearly 10 million Americans filed for unemployment benefits, an astounding figure that economists expect will continue to increase in coming weeks. The unemployment rate, which stood at 3.5% in February, could spike to 15% by the middle of the year, according to Goldman Sachs.

Not a depression yet

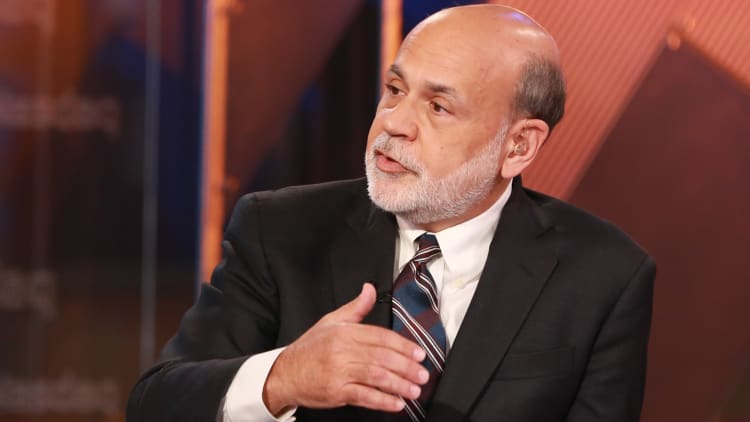

The sharpness of the coronavirus-induced economic downturn has brought back memories of previous recessions and even the Great Depression. Former Fed Chairman Ben Bernanke, a student of the Great Depression, said this crisis is more comparable to a natural disaster.

"The Great Depression, for one thing, lasted 12 years, and it came from human problems, monetary and financial shocks that hit the global system," Bernanke told CNBC.

The main reason this economic downturn is different from others in history is that it's not the result of instability in the financial system, like in the banking sector in the 1930s, the dot-com bust in the early 2000s or the housing market in the mid-2000s. Instead, the coronavirus economic shock is the result of measures necessary to contain a health crisis, like social distancing and isolation.

"The most important difference is this comes out of the real economy, something biological, and people's choices with responding to that, and not out of financial excess or financial speculation," said Adam Posen, president of the Peterson Institute for International Economics.

The challenge now, economists say, is preventing a health crisis from becoming a prolonged financial crisis. The Fed and Congress have put extraordinary stimulus measures in place that aim to do just that. Still the likelihood of a V-shaped recovery, where growth rebounds quickly once the virus has been contained, could be declining as shutdowns remain in place.

"If you can get the biology under control, then the economy can start to recover," Posen said.