U.S. stocks fell sharply once again on Tuesday as oil prices continued their unprecedented wipeout, further denting market sentiment and dampening the global economic outlook.

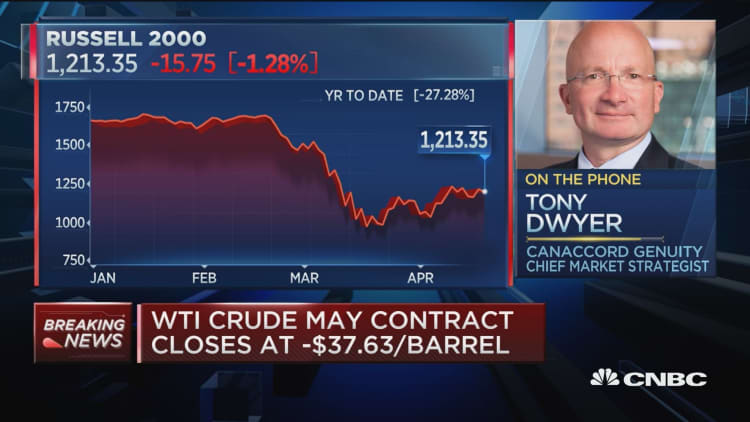

The Dow Jones Industrial Average slid 631.56 points, or more than 2.6%, to close at 23,018.88. Tuesday's losses brought the Dow's two-day decline to more than 1,200 points. The S&P 500 dropped 2.7% to 2,736.56 while the Nasdaq Composite fell 3.5% to 8,263.23. (Click here for the latest market news.)

Traders were focused on the strange happenings with oil futures once again, which raised concern about deep losses for the energy industry hitting the U.S. economy even further. The June contract for West Texas Intermediate cratered 43.4% to $11.57 per barrel on Tuesday.

That sharp decline came a day after the May contract — which expired on Tuesday — went to an actual negative price, meaning traders would pay for someone to take the oil off their hands. The bizarre move had to do with the fact that because of the coronavirus shutdowns, big buyers of oil like refineries don't need any more oil because their tanks are nearly filled. That May contract clawed back into the black on Tuesday.

"If we ever needed a reminder for the extent of the abrupt decline in global economic activity, it is the fact that WTI oil futures saw a negative price," said Tom Lee, head of research at Fundstrat Global Adivsors, in a note. "But oil is a residual issue of the broader global 'stay at home' and this situation will not change until Western nations and US states begin opening up. And they cannot open up until each jurisdiction feels they have a handle on the healthcare crisis."

The United States Oil Fund, an exchange-traded security for the retail investors which buys oil futures, tanked 25.33% to just $2.80 as the fun changed structure to stave off a collapse. Marathon Petroleum and ConocoPhillips were among the biggest decliners in the S&P 500 energy sector, falling more than 3% each.

President Donald Trump tweeted that he instructed the Energy and Treasury departments to "formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future."

Not helping sentiment were shares of IBM, which slipped 3% after the company reported a 3.4% decline in revenue in the first quarter from a year ago amid the spread of coronavirus. Salesforce and Oracle both fell more than 4% after IBM said its software and global business segments suffered from strong headwinds in the last two weeks of March due to the virus.

"Fundamentals on the equity side have pretty much become impossible to judge," said David Pursell, CEO at Core Alternative Capital. "You look at the CFOs, and they're pulling next quarter's estimates because they really have no idea what demand's going to look like."

Trading on Tuesday stabilized slightly after the Senate struck a deal on a $484 billion relief package for small businesses, hospitals and testing.

Stocks dropped on Monday to start another volatile week, with the Dow falling nearly 600 points, as an unprecedented plunge in oil prices weighed on investor sentiment.

Investors continued to monitor the coronavirus pandemic and the country's plan to reopen the economy. Signs have emerged that New York is past the worst of its outbreak. Georgia on Monday rolled out aggressive plans to reopen the state's economy, calling for many businesses to reopen their doors as early as Friday.

Stocks enjoyed their first back-to-back weekly gains since early February last week as investors grew more optimistic that the pandemic is easing off. The S&P 500 is now about 19% from its record high on Feb. 19, cutting about half of its losses during the coronavirus sell-off.

"Market volatility remains intense, as subtle changes in the tone of the news drives dramatic shifts in investor sentiment," said Mark Hackett, Nationwide's chief of investment research. "Markets rallied sharply last week on hope that the worst of the outbreak is behind us. This optimism is likely to face headwinds, as the reopening of the economy is heading for an intense debate."

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Click here to read the latest news on the latest news on the coronavirus.