Your $1,200 stimulus check could have been garnished if you owe past debts.

A group of senators is looking to put a stop to that.

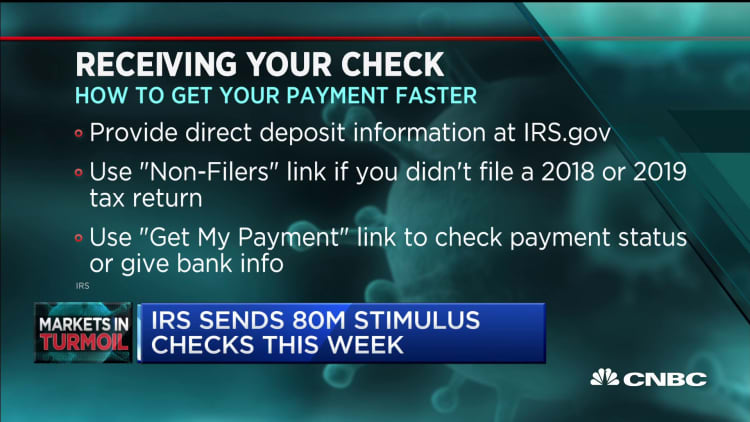

But because millions of stimulus checks have already gone out, it could be too late for some.

Congress authorized the one-time payments when it passed the $2 trillion CARES Act in March.

The payments – up to $1,200 for individuals and $2,400 for married couples, plus $500 for children under 17 – are aimed at helping low- to middle-income families curb the effects of the economic crisis prompted by the coronavirus.

The CARES Act protects people who owe past debts to federal or state governments from having their stimulus checks reduced. But the same protection does not apply to private debt collectors.

More from Personal Finance:

What Social Security beneficiaries need to know about stimulus checks

How long it could take before a second stimulus check is in your hands

New stimulus relief bill includes second round of $1,200 checks

Last week, senators from both sides of the aisle proposed a new bill to put a stop to that. That includes Sens. Sherrod Brown, D-Ohio; Chuck Grassley, R-Iowa; Ron Wyden, D-Ore.; and Tim Scott, R-S.C.

The senators' proposal includes changes to help protect the stimulus money. One way it would do that is by having the Treasury Department encode direct deposit payments so that banks can readily identify them and protect them from debt collection. In addition, the bill would also protect checks and other payments by giving individuals the ability to request that their banks prevent creditors from taking them.

The bill applies specifically to CARES Act payments. But because more than 152 million of those checks have already gone out, individuals who are behind on their debts could already have had their money taken.

Still, the the bill drew praise from the National Consumer Law Center because it could help if additional stimulus payments go out, said Lauren Saunders, an associate director at the non-profit organization.

"Everybody expects or hopes that there will be additional stimulus payments because we are still in a profound depression-level economic crisis," Saunders said. "We want to have this ready to go to make sure we protect those new payments from the get go."

Admittedly, people who are behind on their debts may face complicated situations, and their money could be seized by either directly by their banks or by a court order on behalf of collectors.

Many states have protections in place against those kinds of directives. In addition, many banks have said that they won't garnish stimulus checks to replenish overdrawn accounts, Saunders said.

For individuals who are in this situation, there are some steps they can take.

Reach out for help, because there are a lot of companies willing to give help, but you have to ask for it.Lauren Saundersassociate director at the National Consumer Law Center

First, if your bank took your money, call them and ask for it back, Saunders said. Many banks are refunding overdraft fees or refraining from seizing the stimulus payments altogether, she said.

Next, if there's a court order against you, try to find an attorney. Your local legal aid office or bar association may be able to help you. The National Association of Consumer Advocates' website also has a feature that lets you search for an attorney, Saunders said.

If all else fails, you can represent yourself. But you should be proactive and do your research, including consulting with court clerks, who may be able to provide guidance, Saunders said.

Bottom line: "Be persistent," Saunders said.

"Reach out for help, because there are a lot of companies willing to give help, but you have to ask for it," Saunders said.