President Donald Trump, during a White House address to trumpet the surprising May surge in jobs that signaled a rapid economic recovery could be afoot, took a moment to single out legendary investor Warren Buffett for bailing on airline stocks during the coronavirus pandemic.

"Warren Buffett sold airlines a little while ago. He's been right his whole life, but sometimes even someone like Warren Buffett — I have a lot of respect for him — they make mistakes," Trump said. "They should have kept the airline stocks because the airline stocks went through the roof today."

Buffett, one of Wall Street's most revered investors of all time and known for a lifelong commitment to finding bargain deals, revealed at Berkshire Hathaway's annual meeting in early May that the company had sold the entirety of its position in the U.S. airline industry.

Buffett said at the time the Covid-19 pandemic will have grim, but nonetheless fundamental changes for companies like United Airlines, which he exited.

"The world has changed for the airlines. And I don't know how it's changed and I hope it corrects itself in a reasonably prompt way," he said in May. "I think there are certain industries, and unfortunately, I think that the airline industry, among others, that are really hurt by a forced shutdown by events that are far beyond our control."

Trump critiqued Buffett on the heels of a record-breaking jobs report, which showed that U.S. employers added an eye-popping 2.5 million nonfarm payrolls in May. The jobless rate declined to 13.3%, far better than the net negative results economists had been expecting.

Those results, as well as broader investor optimism about the U.S. economy's reopening, sent the Dow Jones Industrial Average and the S&P 500 up 3.1% and 2.6%, respectively, on Friday. Those two indexes are up more than 10% each over the last month. The Nasdaq Composite reached a new all-time high Friday.

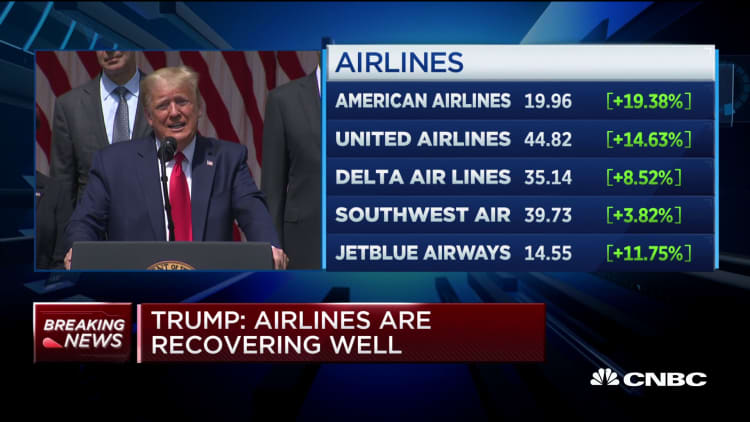

Airline stocks, in particular, have soared in the weeks since Buffett's sale on hopes that travelers will soon return to flying. United, Delta and American Airlines popped 16.8%, 10.4% and 21% on Friday alone amid the market's broader elation. The group of stocks is headed for a record week.

To be fair to Buffett, it remains to be seen whether air travel can fully recover to pre-pandemic levels and whether the stocks will be good investments over the long term. Those names are still far below where they were when than began 2020. An investor who bought United at the end of 2019 would be down 48%. Investors in Delta and American are down 38% and 29% year to date.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Correction: U.S. employers added 2.5 million nonfarm payrolls in May. An earlier version misstated figure.