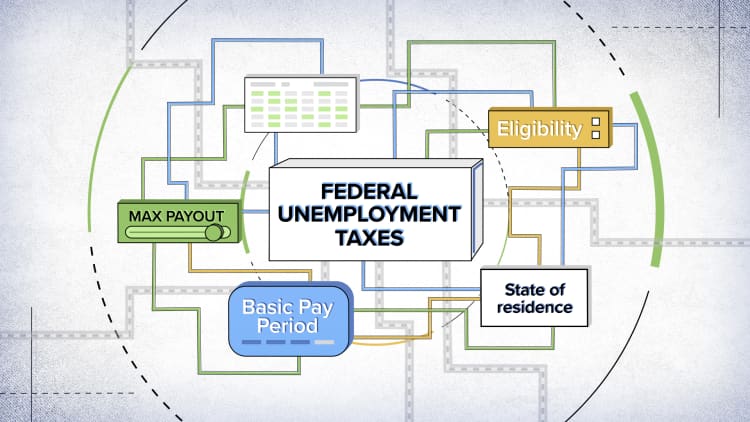

Like most things in life, your unemployment benefits aren't exactly free. You are still expected to pay taxes on any money you receive.

The good news is you don't have to pay Social Security or Medicare taxes, which saves you more than 7% compared with your regular paycheck.

To pay the taxes you do owe, you have three options. Most risky, you can gamble by taking your full check and setting money aside for when you do file your taxes.

Another way, used mainly by small business owners and the self-employed, would be to estimate and pay your taxes quarterly.

Check out this video to see a third option to stay in the good graces of the IRS and to see a full breakdown of how your benefits will be taxed.

More from Invest in You:

How much you can expect to get from Social Security if you make $40,000 a year

The real 'Catch Me If You Can' con artist says this classic scam is making a comeback

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.