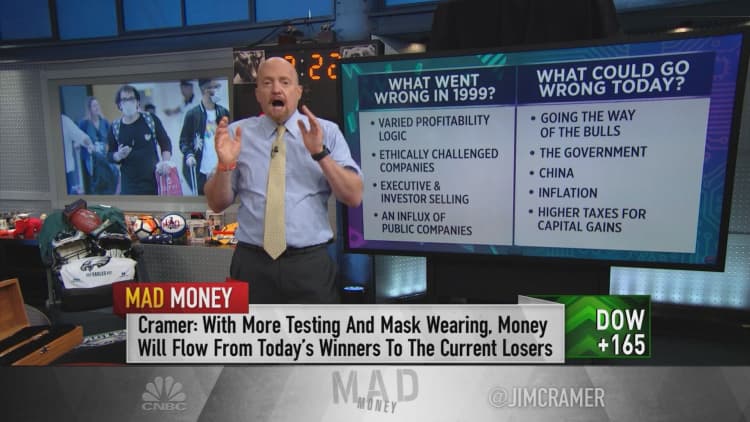

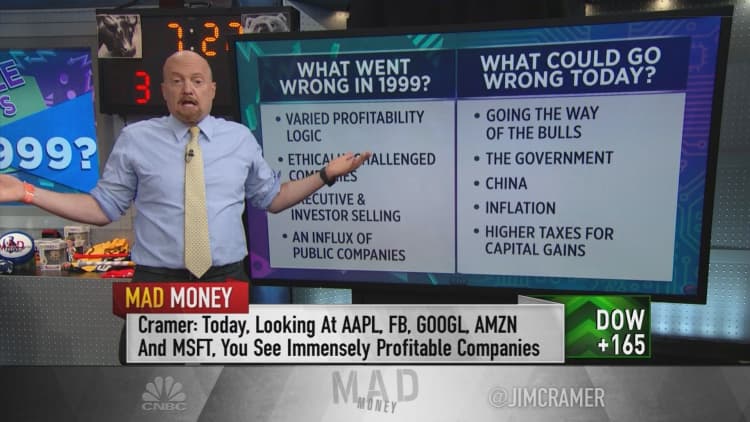

CNBC's Jim Cramer said Wednesday that the stock market's rally from coronavirus crisis lows shouldn't be compared with the speculation in tech stocks that preceded the bursting of the dot-com bubble.

Unlike the 1990s speculation in unproven internet firms, tech companies with demonstrated track records of success — like Apple, Amazon, Microsoft and Google parent Alphabet — are helping power today's market higher, the "Mad Money" host said.

"If you look at the top 20 companies in the Nasdaq in 1999, not one of them looked like today's winners," Cramer said, calling them "some of the most profitable companies in history."

However, Cramer stressed that there are potential developments that could stand in the way and prevent many of these large-cap tech stocks, which also includes the likes of Netflix and Facebook, from continuing to dominate the market.

The first of those risks focuses on the U.S. attempts to combat its Covid-19 outbreak, Cramer said. If the country is able to improve its response through more testing, face mask wearing and government stimulus until there's a vaccine for the novel virus, Cramer said he sees investors starting to embrace economically sensitive sectors in the S&P 500 that have lagged in 2020.

"We'll be going out, traveling, and that means the money from the Cramer Covid-19 winners will rotate into the Covid losers. It's just what happens," Cramer said. "I see this as inevitable because sooner or later we'll get a vaccine, but inevitable doesn't necessarily mean now or even in the next three months or even in the next six months."

Cramer said government regulation is another threat to the leadership from some of these tech names. He noted the upcoming congressional testimony from the CEOs of Apple, Google, Amazon and Facebook.

"If there's an antitrust crackdown on Big Tech, you'll see some real declines here because then we'll have a lot less visibility into their future earnings streams," he said.

The continued escalation of tensions between the Trump administration and China presents an additional layer of risk, Cramer said. The U.S. has in recent days claimed Chinese hackers were targeting coronavirus vaccine research and then ordered the country to shut down its consulate in Houston. Beijing has threatened retaliation.

"If the White House goes into a full bore cold war with China, and it does look like we might, many of these companies will lose a major chunk of their sales, especially Apple," Cramer said.

Even though some tech firms lack much exposure to the Chinese market, the nature of exchange-traded funds means "they all are joined," he said.

Investors also need to be mindful of inflation after trillions of dollars of stimulus was injected into the economy in response to the coronavirus, Cramer said.

"Nobody wants to pay up for growth stocks when inflation is raging. The nonindex owners will dump them because inflation destroys the value of those big earnings in the outyears," he said.

Cramer said the final risk to the current tech rally comes down to the upcoming presidential election. Presumptive Democratic nominee Joe Biden is proposing to tax capital gains like ordinary income, Cramer said, which he said has a real possibility of being enacted if the Republicans lose control of the Senate.

"Whether or not you think this is good policy, it would be extremely bad for stock prices and I'd expect a lot of people want to sell now to get out ahead of it," he said.

All of these potential challenges for tech companies are dramatically different than what caused the dot-com bubble to burst in early 2000, Cramer said.

"I don't see this market collapsing on valuation or fraud or insider selling or inflation, which is currently nonexistent," Cramer said, but risks presented by government regulation and geopolitical tensions are real.

"And, most importantly, if we get the pandemic under control and the economy comes roaring back … Big Tech will go out of style as people rush for the recovery stocks," he said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com