Tech stocks climbed Friday to end the week on a high note, but CNBC's Jim Cramer expects more downside in the tech cohort as investors continue to rotate out of high-growth names.

"Like it or not, stocks are joined at the hip with the bond market right now," the "Mad Money" host said.

As bond rates rise amid early signs of an economic recovery, investors are fleeing from riskier growth stocks to cyclical ones, particularly bank and industrial stocks that have underperformed, Cramer said.

The tech-heavy Nasdaq Composite has fallen in recent weeks and remains down 7% from its high about a month ago. The rotation from tech to value stocks, however, won't last forever, Cramer said.

"Either tech stocks get too low ... or long-term interest rates get too high. Until that happens, the rotation will just continue to play out," he said. "We aren't there yet, but I'm confident that we'll get there eventually because that's what always ends these vicious kinds of rotations."

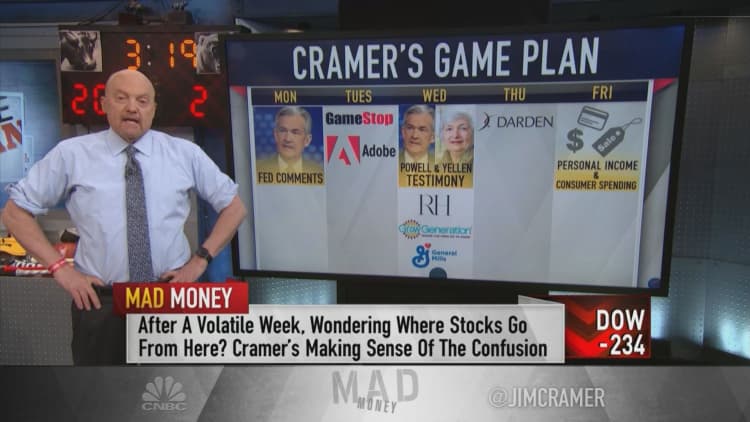

Cramer revealed what's circled on his calendar in the week ahead. Corporate performance projections are based on FactSet estimates:

Tuesday: GameStop, Adobe

- Q4 earnings release: after market; conference call: 5 p.m.

- Projected EPS: $1.35

- Projected revenue: $2.21 billion

"The bulls hope to learn on this call more about [Ryan] Cohen's plan when the company reports, and if there's anything good at all about these results, well I expect to see a ton of buying the next day," Cramer said.

- Q1 2021 earnings release: after market; conference call: 5 p.m.

- Projected EPS: $2.79

- Projected revenue: $3.76 billion

"Unfortunately, the results are less important than the state of the Wall Street fashion show," he said. "If Adobe reports a great quarter and rates are soaring that day, with the yield on the 10-year approaching 2%, then the earnings won't matter at all."

Wednesday: RH, GrowGeneration, General Mills

- Q4 earnings release: after market; conference call: 5 p.m.

- Projected EPS: $4.73

- Projected revenue: $797 million

- Q4 earnings release: after market; conference call: Thursday, 9 a.m.

- Projected EPS: 7 cents

- Projected revenue: $61.5 million

"You rarely hear those two mentioned in the same sentence, but right now they represent the most exciting parts of retail," Cramer said about RH and GrowGeneration.

"I suspect they'll both report excellent quarters," he said. "Home furnishings are the most popular part of retail purchasing right now, as we saw from the incredible quarter Williams-Sonoma just delivered, and the cannabis culture … [has] been an unstoppable force as state after state embraces legalization."

- Q3 2021 earnings release: before market; conference call: 9 a.m.

- Projected EPS: 84 cents

- Projected revenue: $4.45 billion

"I like this one as a way to take the temperature of the pantry stocks," the host said. "I think the reaction will be tepid, but then again Smucker surprised to the upside and I like Hormel very much. So let's take a listen."

Thursday: Darden Restaurants

- Q3 2021 earnings release: before market; conference call: 8:30 a.m.

- Projected EPS: 68 cents

- Projected revenue: $1.61 billion

"Do you know we have 150,000 [restaurants] that have closed? It means that the survivors should be in an incredible position, which is why I expect them to crush numbers," Cramer said of Darden. "The stock's had a big run, but I think the scarcity value of the stock and the last-man-standing thesis make it compelling."

Disclosure: Cramer's charitable trust owns shares of Facebook, Amazon, Goldman Sachs, JPM organ Chase and Wells Fargo.

techQuestions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com