'Vaccine hesitancy' has become a popular term as public officials urge unvaccinated Americans to protect themselves against the latest Covid-19 outbreak.

Now it turns out there's also another uncertainty — 'tax hesitancy' — that is taking hold among some parents over the expanded monthly child tax credit payments.

The child tax credit was temporarily enhanced this year to provide more generous benefits and monthly payments to qualifying Americans. That includes up to $300 per month per child under age 6 and $250 per month per child ages 6 through 17. In total, families can receive up to $3,600 per child under 6 and $3,000 for those ages 6 to 17.

More from Personal Finance:

What it would take to make the child tax credit expansion permanent

As women opt out of workforce, what that means for Social Security benefits

Where to put your emergency savings amid rising inflation

Half of the payments will be made to parents through monthly checks, while the remainder will be paid at tax time.

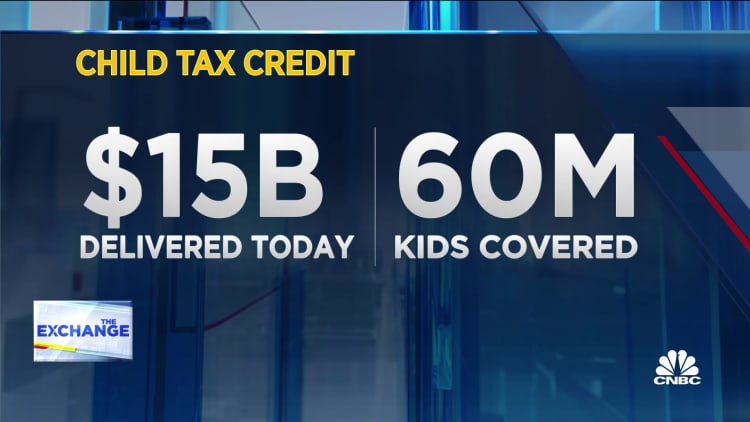

The monthly payments started in July.

Yet recent reports indicate that approximately 4 million or more children who are eligible for the payments could be falling through the cracks, according to the Center on Budget and Policy Priorities.

One reason why parents might be hesitant to go through the sign-up process is fears that divulging their personal financial information to the government could somehow hurt them, said Dorian Warren, co-president of Community Change, a Washington, D.C.-based advocacy group focusing on low-income minorities and women.

Most taxpayers receive the monthly child tax credit checks automatically. However, the new, more generous terms make the credit fully refundable, which means the lowest-income households are now eligible for the first time.

Many of those families do not typically file with the IRS, and therefore are not on record with the government.

In order to help those people register, the IRS has an online tool where parents can submit their information.

However, tax hesitancy may prevent them from signing up, Warren said.

There's so much money. It's just sitting there on the table.Dorian Warrenco-president of Community Change

One reason is a fear families will hit a benefit "cliff" and become ineligible for other aid if they sign up for the child tax credit.

Additionally, shame might be holding them back if they do not want to admit they are non-filers or have not filed tax returns in a year or two, Warren said.

"Objectively, there's no validity to the benefit cliff or benefit loss," Warren said.

Moreover, families could miss out if they do not sign up.

"There's so much money," Warren said. "It's just sitting there on the table."

Outreach efforts

Efforts to raise awareness in eligible communities right now is huge, Warren said.

Research has pointed to large economic benefits from the expanded credit. About 90% of children will either receive a larger credit or receive the credit for the first time, according to the Center on Budget and Policy Priorities.

In addition, for every $1 spent on the child tax credit, it returns $8 in benefits that would be spent later, President Joe Biden has said.

For Community Change, the messaging to parents has focused on how the $250 or $300 monthly payments would help their families.

"It's not a scam," Warren said of the enhanced child tax credit. "It's actually their own money coming back to them to support their kids."

Parents should, however, be wary of schemes that have cropped up to dupe those who want to sign up.

To that end, the IRS has launched a social media campaign with warning signs to watch for.

Community Change is working to help connect parents to the right resources, through tactics such as peer-to-peer outreach and enlisting TikTok influencers to help spread the word.

Still, there are certain challenges, Warren said. The non-filer tool, for example, does not enable people to sign up from their mobile phones, which is how most low-income people access the internet, he said.

In addition, no funding was allocated to individuals who could help people navigate the portal to sign up, as was the case with the Affordable Care Act in 2014.

Community Change hopes state and local governments use some of their funds from the American Rescue Plan to hire community navigators.

For parents who have received the money, it is making a difference with everything from the cost of food and diapers to helping to prevent loss of rental housing, now that the nationwide moratorium on evictions has expired, Warren said.