Automatically saving a percentage of your salary can be an easy way to fund your retirement.

As a rule of thumb, most financial advisors suggest you save 10% to 15% of your earnings.

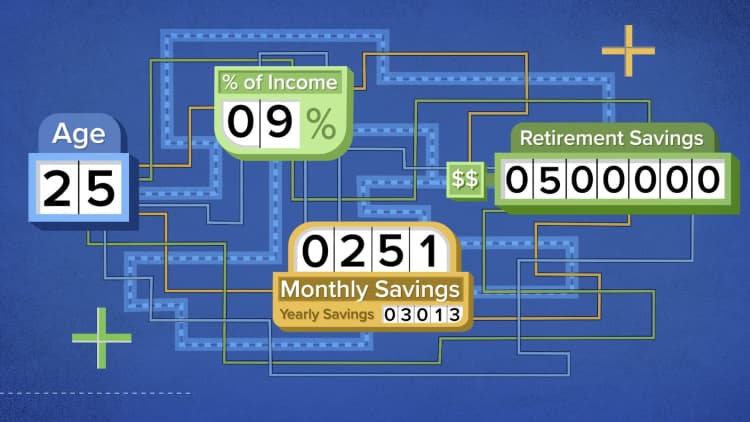

Here's a case study.

If you want to retire with $500,000, you'll need to invest about 9% of a salary of $35,000 starting in your 20s. Waiting until you're older will require a larger portion of your pay.

Watch this video to find out how much money you will need to invest to save $500,000 for retirement, broken down by age.

More from Invest in You:

How Walmart and other big companies are trying to recruit more teenage employees

Americans are more in debt than ever and experts say 'money disorders' may be to blame

How much money do you need to retire? Start with $1.7 million

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.