Next week could be a relatively calm stretch for Wall Street, CNBC's Jim Cramer said Friday, but he advised investors to start preparing for trading days on the horizon.

"Get ready. After next week, the onslaught of earnings and the Labor Department's all-important non-farm payroll number will strike," the "Mad Money" host said. "After a crazy up and down ... week, we're now headed into a calm before the storm moment here, and that storm could get a lot worse depending on what happens in China, where there's no calm to be found at all."

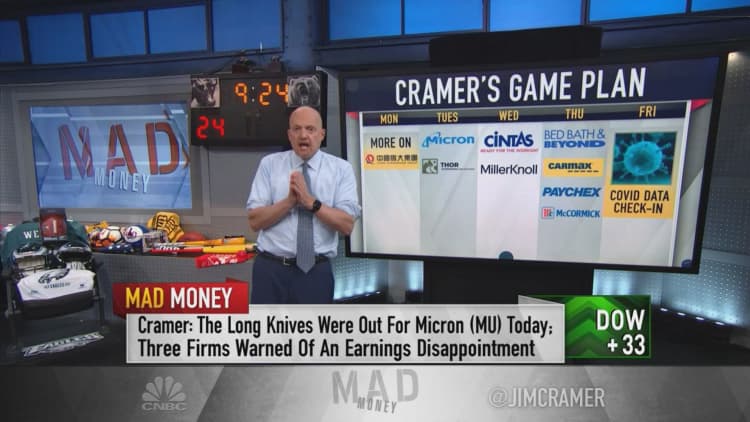

Here's Cramer game plan for the week ahead. Revenue and earnings-per-share projections are based on FactSet estimates:

Monday: Fresh insight into Evergrande

The struggling Chinese property developer Evergrande has, so far, left investors in limbo about whether it will fulfill its $83 million interest payment on its U.S. dollar bond, which had a deadline of Thursday. Concern about Evergrande's financial struggles spilling into the global economy rattled markets early in the week, but worries improved throughout the week.

"On Monday, we should get word about what will happen to the part of the Evergrande edifice that hasn't been bailed out," Cramer said. "I think the government will make sure the big shareholders do get wiped out, and that includes management."

"I fully expect to learn of the [government] regime's new enemies when we return to work Monday morning," he added.

Tuesday: Earnings from Micron and Thor Industries

- Q4 2021 results: after the bell; conference call scheduled for 4:30 p.m. ET

- Projected EPS: $2.33

- Projected revenue: $8.23 billion

"Today the long knives were really out for these guys; three different firms warned of looming disappointment. I have to admit that those predictions were particularly daunting," Cramer said. "My view? Why don't we just wait and see how Micron does? Just remember that high-end semiconductor plays have little to do with Micron, so they might be worth buying if this quarter drags down the whole industry."

- Q4 2021 results: Before the bell

- Projected EPS: $2.98

- Projected revenue: $3.31 billion

"While I like Thor ... I also wouldn't be a buyer here because we're at the wrong stage of the business cycle" for the RV maker, Cramer said. "It's too discretionary, and as the delta variant fades away, the stock market will say people will start traveling normally again. In other words, even if Thor blows away the numbers, I think there will be a lot of analysts who just say, 'Well, that was the last good quarter.'"

Wednesday: Earnings from Cintas and MillerKnoll

- Q1 2022 results: Before the open; conference call set for 10 a.m. ET

- Projected EPS: $2.76

- Projected sales: $1.88 billion

- Q1 2022 results: After the bell; conference call scheduled for 5:30 p.m. ET

- Projected EPS: $0.54

- Projected revenue: $651 million

"Wednesday gives us a great look into small and medium-sized businesses when we get results from Cintas, that's the gigantic uniform company, and MillerKnoll, the office chair maker formerly known as Herman Miller," Cramer said. "Both companies have been uneven lately, but I think they'll tell very positive stories. Once they're parsed, they might provide us with a more positive backdrop. I like them both."

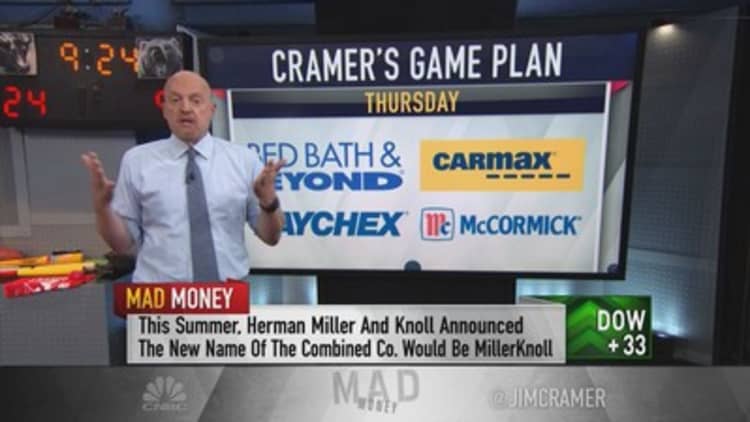

Thursday: Earnings from Bed Bath & Beyond, CarMax, Paychex and McCormick

- Q2 2021 results: Before the bell; conference call set for 8:15 a.m. ET

- Projected EPS: $0.52

- Projected sales: $2.06 billion

"Bed Bath's quarter might not be a barnburner, but I think the redesigned stores will change peoples' impression of this formerly fossilized institution," the "Mad Money" host said. "I like the prices. I like the merchandise. I like the management; I think the stock can go higher."

- Q2 2022 results: Before the open; conference call slated for 9 a.m. ET

- Projected EPS: $1.88

- Projected revenue: $6.85 billion

"As long as there's a chip shortage, the used car market will remain strong. That means CarMax should deliver a great number on Thursday," Cramer said. "But let's not be too particular: I like AutoNation, I like Lithia, I like Carvana. If you're inclined, you've got my blessing to buy CarMax ahead of the quarter."

- Q1 2022 results: Before the bell; conference call scheduled for 9:30 a.m. ET

- Projected EPS: $0.80

- Projected revenue: $1.04 billion

"This payroll processor is incredibly well-run and consistent, yet it never gets the respect it deserves ... because it's hostage to the labor market and to short-term interest rates," Cramer said. "The stock tends to sell-off even after good results; buying Paychex into that weakness has been a great strategy."

- Q3 2021 results: Before the bell; conference call at 8 a.m. ET

- Projected EPS: $0.72

- Projected revenue: $1.54 billion

"If you're convinced that the economy's slowing, you might want to buy some McCormick," Cramer said. "The problem, of course, is that while it sure seems to be getting stronger, well, they might lose business as the delta variant peaks ... and people feel more comfortable going out to dinner again. I'd avoid it for the moment, even though I like it."

Friday: Covid data

"On Friday we tend to look back ... and we see how Covid 'did,'" Cramer said. "We've had a couple weeks where things seem to have calmed down, and we may be nearing a bizarre herd ... immunity, where everyone has either gotten vaccinated or gotten sick because delta is so catchable. I think the infection numbers will continue to improve."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com